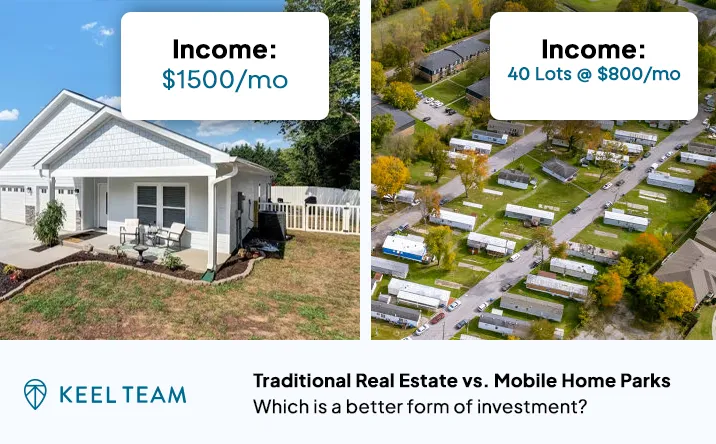

Mobile Home Park Investing vs. Traditional Real Estate Investing

-

Tristan Hunter - Investor Relations

Tristan Hunter - Investor Relations

A Comparative Analysis Between Both Types of Investing:

In recent times, the landscape of real estate investing has expanded considerably. The two investment types we’ll be talking about offer a myriad of opportunities for investors to diversify their portfolios. Two potential avenues that are often pondered upon are mobile home park investments and traditional real estate investments. Through an in-depth comparative analysis, we’ll outline the differences that each investment avenue holds while potentially offering a pathway for investors to make informed decisions.

Understanding the Investment Landscape

Investing in real estate has arguably been one of the time-honored ways to potentially build wealth over time. It may involve venturing into residential, commercial, or industrial properties, offering various prospects for income and capital appreciation. In parallel, mobile home park investing, offers a different set of dynamics, carves out a niche in the investment landscape. Before diving into a comparative analysis, it will likely be beneficial to outline what each of these investment paths involve.

Traditional Real Estate Investing

Traditional real estate investments generally involve the acquisition of residential, commercial, industrial or even other types of properties. It’s often perceived that real estate investments have the potential to offer a steady income stream, capital appreciation, and some degree of protection against inflation.

- Residential Real Estate: Often involves investing in single-family homes, apartments, and condos for example. These types of assets have the potential to offer steady rental income, depending on the location and market dynamics.

- Commercial Real Estate: Involves venturing into office spaces, retail outlets, and other commercial establishments. It’s speculated that these investments potentially offer higher returns compared to residential real estate.

- Industrial Real Estate: This sector encompasses properties like warehouses, manufacturing units, and other similar properties. All of which could potentially provide substantial rental income, albeit, usually with a higher degree of complexity in management.

5.64 million existing homes were sold in 2020, according to data from the National Association of REALTORS®. 822,000 newly constructed(link is external) homes were sold in 2020, according to the U.S. Census Bureau.

National Association of Realtors

Mobile Home Park Investing

On the other hand, Investing in mobile home parks is seemingly a path that’s gradually gaining attention. This usually involves purchasing a tract of land zoned for manufactured housing, and potentially earning rental income through lot rentals. These investments generally offer a different set of advantages, such as the potential for lower maintenance costs and the opportunity to foster a community atmosphere for example.

Mobile homes make up 6.4% of the US housing sector and there are 8.5m of them, down slightly on 2011, according to the US Census. The number of occupants is not recorded but it’s estimated to total about 20 million.

BBC Magazine

- Lower Entry Barriers: It’s often perceived that mobile home park investments may have lower entry barriers compared to traditional real estate investments.

- Community Atmosphere: Mobile home parks generally provide a close-knit community atmosphere, which could be a selling point for potential tenants.

- Flexibility: Owners of mobile home parks typically have more flexibility in terms of property management and tenant agreements.

Learn more about mobile home park investing.

Interested in learning more about mobile home park investing? Get in touch with us today to find out more.

Comparative Analysis: Pros and Cons for Mobile Home Park Investing vs. Traditional Real Estate Investing

Drawing a comparison between mobile home park investments and traditional real estate investments usually requires a detailed analysis of the possible pros and cons that each investment avenue may offer.

Potential Benefits

- Diversification: Investing in mobile home parks could potentially offer diversification benefits, which may offer a hedge against downturns in the traditional real estate market.

- Cash Flow: Both mobile home parks and traditional real estate investments have the potential to offer steady cash flow.

- Capital Appreciation: Traditional real estate, especially in prime locations, has the possibility of offering significant capital appreciation over time. Similarly, well-managed mobile home parks tend to also see a rise in value over time. This is dependent on the market and location of the asset.

Potential Drawbacks

- Management Complexities: Managing a mobile home park could involve a different set of complexities compared to traditional real estate investments.

- Market Sensitivities: Both types of investments might be sensitive to market fluctuations, potentially impacting returns and property values.

- Regulatory Challenges: Investors may face regulatory challenges in both mobile home parks and traditional real estate investments.

In-Depth Insights: A Closer Look

Through careful analysis, investors can uncover the differences that might influence the potential success or challenges in both investment types. From dissecting market dynamics, to understanding the intricacies of risk management, we aspire to provide an analysis that is potentially rich with insights and perspectives.

Learn more about mobile home park investing.

Interested in learning more about mobile home park investing? Get in touch with us today to find out more.

As we venture further, we aim to offer a diverse perspective that may help passive investors craft potential strategies that could resonate well with their investment philosophies and financial goals. It will likely be beneficial to approach this analysis with a discerning eye. This can help foster a mindset that is receptive to the all-round nature of traditional real estate and mobile home park investments.

Market Dynamics

Aspects like economic trends, demographic shifts, and governmental policies typically play a significant role in shaping the investment landscape. Furthermore, the analysis might also focus on the potential supply-demand curves prevalent in different geographical locations. These often influence returns and capital appreciation prospects. Here are a couple variables to consider:

- Demand and Supply: One could argue that the demand and supply dynamics of mobile home parks differ from those of traditional real estate investments, particularly in light of the affordable housing crisis.

- Investment Horizon: The investment horizon tends to also play a crucial role in determining the potential returns from both investment avenues.

Risk Management

Let’s explore the various strategies and approaches that could potentially mitigate the inherent risks associated with both investment types. One of the key considerations could be the assessment of market volatility and how it might influence both sectors differently. Furthermore, investors often find it beneficial to explore the avenues for portfolio diversification. This usually acts as a hedge against adverse market movements.

A deeper dive into this segment will likely reveal insights into how leveraging, while possibly enhancing returns; could also escalate the risk profile of an investment. Therefore, understanding the optimal use of leverage is often essential in crafting a balanced investment strategy.

The potential regulatory implications and adept risk management usually circumnavigates likely hurdles along the way. These potentially foster a sustainable and possibly rewarding investment journey. It seems achievable that with astute risk management strategies, investors have the potential to safeguard their investments while possibly steering towards a path of growth and capital preservation. Consider the following:

- Diversification: Investors often find it beneficial to diversify their portfolios by venturing into both mobile home parks and traditional real estate investments.

- Leverage: Leverage can potentially play a significant role in both types of investments, with the likelihood of impacting the risk-reward profile.

Concluding The Differences

In the journey of exploring the intricacies of real estate investments, investors can find themselves at a crossroad. You will need to choose between investing in mobile home parks and investing in traditional real estate. Through a careful comparative analysis, it is often possible to derive insights that could guide them in making informed decisions.

Armed with insights and understanding, investors will likely navigate the complex landscape of real estate investments more proficiently, despite the lack of a definitive path. The key lies within research and understanding of market dynamics, and a willingness to adapt to the ever-evolving investment landscape.

Disclaimer:

The information provided is for informational purposes only and should not be considered investment advice, nor a guarantee of any kind. There are no guarantees of profitability, and all investment decisions should be made based on individual research and consultation with registered financial and legal professionals. We are not registered financial or legal professionals and do not provide personalized investment recommendations.

Tristan Hunter - Investor Relations

View The Previous or Next Post

Subscribe Below 👇