Investing in mobile home parks can potentially be a lucrative venture, often offering a variety of financial benefits. One of the most appealing aspects of this niche asset class is the potential for significant tax advantages. In this blog post, we will dive into the potential tax advantages that mobile home park investments usually possess, and explore how they can likely contribute to your overall financial strategy.

Understanding the Basics

Before we jump into the tax benefits, let’s briefly touch on some of the fundamentals of mobile home park investments. These investments typically involve purchasing and managing communities where the residents usually rent the lots, and sometimes the homes too. On a high level, this can be done as an active investment, or investing passively in a limited partnership with an experienced operator. Either model can potentially be a solid source of income and often offers unique tax advantages, depending on the level of time you have to commit.

With over 20% of Americans trying to live on $20,000 per year or less, the demand for mobile homes has never been higher.

Mobile Home University

Depreciation Deductions

One of the primary tax benefits of mobile home park investments is the ability to take advantage of potential depreciation deductions.

Depreciation, within the context of real estate, generally surfaces as a tax-related consideration that acknowledges wear and tear, gradual deterioration, or the obsolescence of an asset over its useful life. For investors in mobile home parks, the physical structures and improvements constituting the property typically undergo a gradual process of depreciation. These are largely due to factors such as weather, usage frequency, and the natural course of aging. This often allows investors to allocate depreciation as a portion of the property’s cost as a potential expense over its useful life.

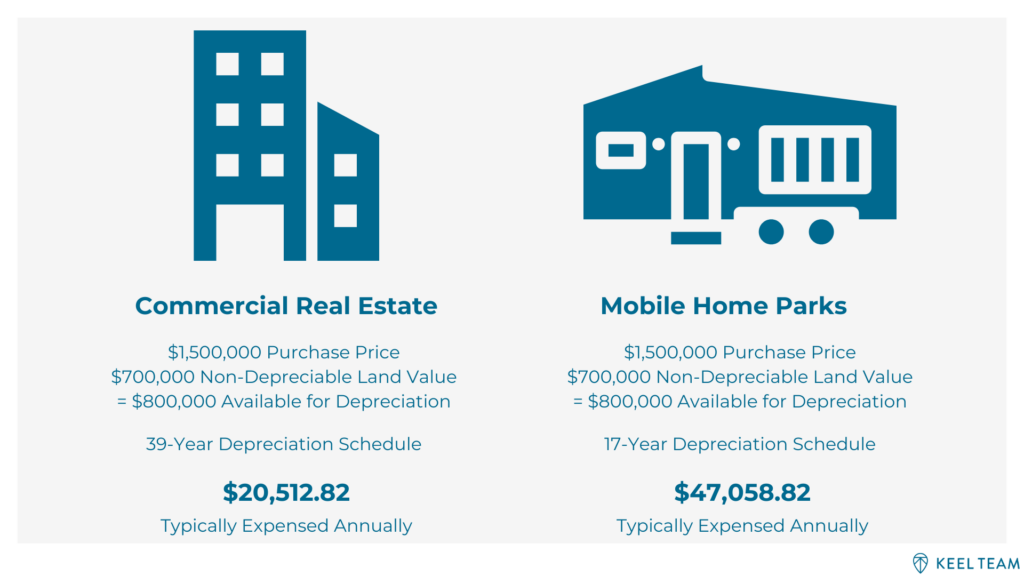

Depreciation deductions will likely provide significant tax savings by potentially reducing your taxable income. Mobile home parks typically follow an accelerated depreciation schedule of around 17 years, allowing you to potentially allocate depreciation at a much higher rate compared to other multi-family asset classes.

Bonus Depreciation is an additional tax incentive that typically allows individuals to accelerate the depreciation of certain assets, mobile home parks usually being included. This means that you can potentially receive larger tax deductions in the earlier years of an asset’s useful life. This encourages investment and economic growth by providing financial advantages. However, as of this year, changes are underway in the Bonus Depreciation landscape. The bonus depreciation amount as of 2023 is 80%, with it expected to be phased out each year, making it non-existent by 2027.

1031 Exchanges

Another potentially valuable tax strategy for mobile home park investors is the 1031 exchange as an exit strategy. This provision in the tax code usually allows you to defer capital gains tax when you sell one investment property and reinvest the proceeds into another “like-kind” property. Mobile home parks often qualify for this exchange, allowing you to likely defer taxes and potentially grow your portfolio more efficiently. The 1031 exchange is often used as a powerful tool for building wealth in the mobile home park sector while preserving your capital and minimizing tax liabilities. This will likely prove to be a solid exit strategy, if you are comfortable with the typical admin behind such a process.

A 1031 Exchange is not a “tax loophole” or a “tax dodge” . It is a tax benefit that helps fuel the economy.

James Walther

Passive Loss Deductions

Passive investors (limited partners) can potentially offset passive income with passive losses from other investments, typically reducing their overall tax burden.

For example, if you have passive losses from other real estate investments or businesses, you can generally use these losses to offset the rental income generated by your mobile home park. This can result in lower taxable income and potentially reduce your tax liability.

Deductible Expenses

Like any real estate investment, mobile home park owners often deduct a variety of expenses related to property management and maintenance. These deductible expenses can include property management fees, maintenance and repair costs, property taxes, and insurance premiums to name a few.

By carefully tracking and documenting these expenses, you can potentially reduce your taxable income and, consequently, your tax liability. Always consult with a tax professional regarding these matters.

Tax Planning for Mobile Home Park Investors

To maximize the tax benefits of mobile home park investments, it’s crucial to engage in pro-active tax planning. Here are some strategies to consider:

Work with a Tax Professional: Tax laws are complex and subject to change. Partnering with a qualified tax professional who specializes in real estate can help you navigate the intricacies of mobile home park investments and help ensure that you take full advantage of available deductions and credits.

Keep Accurate Records: Maintaining detailed and organized records of your income and expenses is essential. This documentation will likely be invaluable during tax season and can help you substantiate your deductions in case of an audit.

Consider Entity Structure: The way you structure your mobile home park investment can have significant tax implications. Consult with your tax advisor to determine the best entity structure, such as an LLC or a partnership, that aligns with your financial goals and tax strategy.

Stay Informed: Tax laws and regulations change over time. Stay informed about any new developments in tax law that may affect your mobile home park investments. Being proactive can help you adapt your strategy to minimize tax liabilities.

Are you ready to explore the mobile home park investment asset class and potentially leverage these tax advantages? Reach out to us today to discuss more insights into passive mobile home park investments.

Wrapping Up

Investing in mobile home parks can be a smart financial move, and the tax benefits associated with this type of real estate investment puts the cherry on top. From depreciation deductions, to 1031 exchanges and passive loss deductions, mobile home park investors have several tools at their disposal to potentially reduce their tax burden and increase their returns.

However, it’s important to remember that tax planning should be an integral part of your investment strategy. Working with tax professionals, keeping meticulous records, and staying informed about tax law changes will help you make the most of the tax benefits of mobile home park investments.

Therefore, if you’re considering entering the mobile home park asset class, be sure to consult with a qualified tax advisor and start potentially reaping the rewards of these potential tax benefits.

Disclaimer:

The information provided is for informational purposes only and should not be considered investment advice, nor a guarantee of any kind. There are no guarantees of profitability, and all investment decisions should be made based on individual research and consultation with registered financial and legal professionals. We are not registered financial or legal professionals and do not provide personalized investment recommendations.