Value-Add Mobile Home Park Investing: Keel Team’s Involvement

-

Tristan Hunter - Investor Relations

Tristan Hunter - Investor Relations

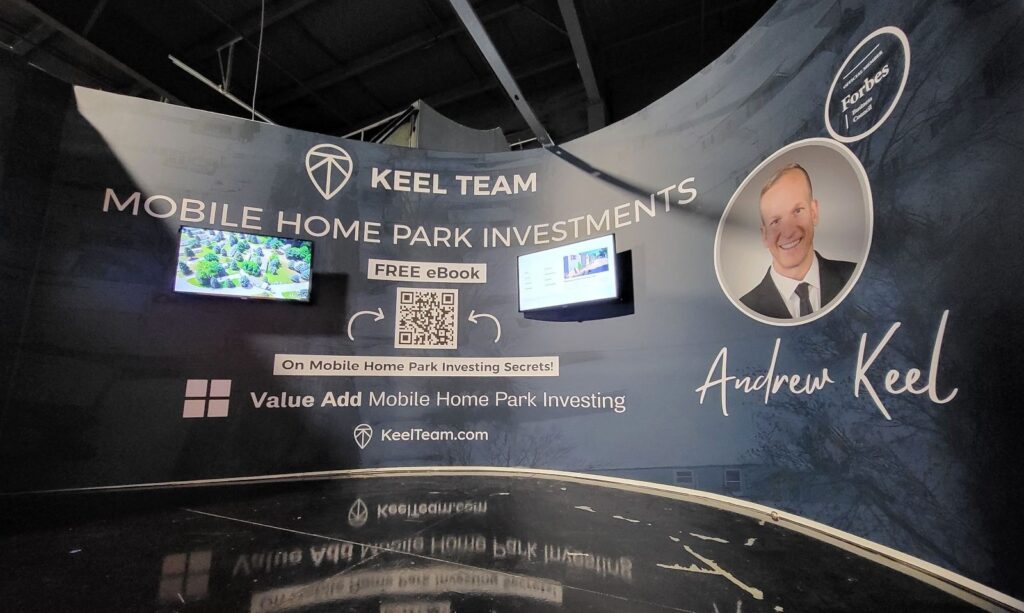

The Keel Team has been featured at the RV/MH Hall of Fame Museum, showcasing its efforts in preserving mobile home parks and, in turn, supporting affordable housing across the midwest of the United States. As the housing crisis deepens and traditional home prices soar, mobile home parks remain a key element in providing cost-effective housing solutions for millions of Americans. The Keel Team’s display highlights their commitment to the revitalization of these properties through value-add investing strategies. This article explores the evolution of mobile home parks, and how private equity investment can transform underperforming mobile home parks, and ensure they remain viable, affordable housing options for those who need it most.

Here’s a quick recap on our recent visit to the museum with John Squartino, COO of Keel Team:

The Evolution of Mobile Homes: From Temporary Living to Essential Housing

Mobile homes have undergone significant evolution over the past century. Originally designed in the 1920s as small travel trailers for temporary or seasonal use, they became a permanent housing solution post-World War II when the need for affordable housing skyrocketed. By the 1950s, mobile homes had become a staple in American life, with many families choosing them for full-time living due to their affordability and flexibility.

Fast-forward to the present day, and the industry has developed into a critical source of housing for over 22 million Americans. Manufactured homes are now built to HUD standards, with modern amenities and energy efficiency that rival traditional homes. According to the Manufactured Housing Institute, mobile homes represent one of the largest sources of unsubsidized affordable housing in the U.S. This is where mobile home parks, which typically provide a community-oriented and cost-effective way of living, play a vital role.

Despite their historical benefits, mobile homes face several challenges. Aging infrastructure, declining occupancy rates, and outdated management practices are common issues in many mobile home parks. This is where the Keel Team’s and many other operators’ value-add strategy comes in, typically tackling these challenges head-on and revitalizing mobile home parks to help ensure they remain affordable housing options for future generations.

RV/MH Hall of Fame & Museum Display: Evolution of Mobile Homes

The Keel Team’s Value-Add Mobile Home Park Investing Approach

The Keel Team specializes in value-add mobile home park investing, which involves purchasing underperforming or mismanaged mobile home parks and improving their infrastructure, management, and overall desirability and presence. Generally, this strategy potentially increases the value of the assets and also helps ensure that residents benefit from better living conditions without facing steep rent hikes.

1. Infilling Vacant Lots and Refurbishing Manufactured Homes

A significant part of the Keel Team’s value-add approach focuses on infilling vacant lots and refurbishing outdated mobile homes. By replacing old, inefficient homes with new or refurbished ones, they typically improve the overall quality of the mobile home park, increase occupancy rates, and generate additional income. This strategy helps enhance the community’s appeal and potentially maximizes the mobile home park’s revenue without excessively raising operational costs. These improvements usually benefit both investors and residents by maintaining affordability while improving the quality of living.

2. Upgrading Infrastructure and Addressing Deferred Maintenance

One of the first things the Keel Team does when acquiring a mobile home park is assess the condition of the infrastructure. Many mobile home parks suffer from deferred maintenance, leading to deteriorating water systems, pothole-riddled roads, and outdated sewage lines. The Keel Team prioritizes upgrades to these essential utilities, helping ensure the mobile home park operates efficiently, safely, and sustainably.

3. Billing Back Utilities and Gradual Rent Increases

The Keel Team also implements strategies to help optimize expenses. For instance, they often introduce utility bill-back programs, where tenants are responsible for their individual water, gas, or electricity usage. This helps reduce the mobile home park’s operational costs while encouraging residents to be mindful of their consumption.

Additionally, the Keel Team adjusts lot rents in alignment with improvements made to the mobile home park. By gradually increasing rents after infrastructure upgrades and amenity enhancements, they aim to ensure that rents remain affordable and justifiable for residents while maintaining the mobile home park’s profitability.

4. Enhancing Management Efficiency

Management plays a crucial role in the potential success of any mobile home park. The Keel Team typically invests in improving operational efficiencies by introducing modern management tools. For example, they implement digital platforms for rent collection and maintenance requests, which helps streamline communication and reduces the administrative burden. By enhancing management practices, the Keel Team aims to boost tenant satisfaction and retention rates.

Are you looking for more information on value-add mobile home park investing and the Keel Team’s approach? Get in touch with us TODAY to learn more!

Addressing the Affordable Housing Crisis

The U.S. faces an undeniable housing crisis. According to the National Low Income Housing Coalition, there is a shortage of more than 7 million affordable rental homes for low-income households. With housing prices continuously rising, mobile home parks provide a critical solution. The average cost of a new manufactured home in 2023 was around $87,000, compared to the $400,000 median price of a traditional site-built home. This price difference typically makes mobile homes an accessible option for those priced out of the traditional housing market.

Private equity firms are playing a pivotal role in preserving these affordable housing options. By acquiring and improving underperforming mobile home parks, they aim to ensure that these communities remain viable and affordable for their residents.

Case Study: The Tifton, GA Value-Add Mobile Home Park Investing Success Story

The Keel Team’s acquisition of the Tifton Mobile Home Park in Georgia exemplifies their value-add strategy. Purchased through cold-calling and off-market sourcing, the 109-lot property was acquired for $1,600,000 in August 2020. Investors saw impressive returns in just 19 months. With a capital raise of $655,000, distributions reached over $2.1 million, translating to a 130.57% total return and an 87.04% annual cash-on-cash return for investors.

The Keel Team at the RV/MH Hall of Fame Museum

The Keel Team’s recent display at the RV/MH Hall of Fame Museum highlights their commitment to preserving mobile home parks and supporting the affordable housing market. The museum celebrates the history and evolution of both recreational vehicles and mobile homes, showcasing how these industries have grown to provide essential housing options. The Keel Team’s contributions to the museum emphasize the importance of maintaining and modernizing mobile home parks for future generations.

Their display at the Hall of Fame also serves as a reminder of how mobile home parks continue to evolve. As the demand for affordable housing increases, mobile home parks must adapt and improve. The Keel Team’s approach aims to ensure that these communities are preserved and also made more livable, sustainable, and financially viable.

Conclusion

The Keel Team’s work in revitalizing mobile home parks demonstrates how private equity investment can likely preserve and enhance affordable housing. Through value-add strategies like upgrading infrastructure, improving management, and increasing occupancy, the Keel Team aims to ensure that mobile home parks remain a critical component of the affordable housing landscape.

As the U.S. housing crisis deepens, mobile home parks will likely continue to provide a vital solution for millions of Americans. The Keel Team’s efforts, showcased at the RV/MH Hall of Fame Museum, highlight their role in preserving these communities and helping ensure long-term sustainability. With their and many other operators’ continued focus on value-add investing, the future of mobile home parks looks bright.

Book a 1-on-1 consultation with Andrew Keel to discuss:

- A mobile home park deal review

- Due Diligence questions

- How to raise capital from investors

- Mistakes to avoid, and more!

Disclaimer:

The information provided is for informational purposes only and is not investment advice or a guarantee of any kind. We do not guarantee profitability. Make investment decisions based on your own research and consult registered financial and legal professionals. We are not registered financial or legal professionals and do not provide personalized investment recommendations.

Tristan Hunter - Investor Relations

View The Previous or Next Post

Subscribe Below 👇