COVID-19: Highlighting the Historical Resilience of Mobile Home Park Investments

-

Tristan Hunter - Investor Relations

Tristan Hunter - Investor Relations

The COVID-19 pandemic brought about unprecedented challenges and changes in various sectors of the economy, and the mobile home park asset class was no exception. In this deep dive analysis, we’ll examine the impact of COVID-19 on mobile home park investments, the interest rate performance between 2020-2021, and the current state of the economy in the United States, at a broad level. Additionally, we will discuss Keel Team’s performance during this turbulent period, highlighting their successes and strategies, shedding light on mobile home park investments and their historical resilience to economic downturns.

Let’s jump right in!

Impact on Mobile Home Park Investments

Supply and Demand Dynamics

The mobile home park industry experienced mixed impacts during the initial phase of the COVID-19 pandemic. As economic uncertainty spread, many homeowners and renters began looking for more affordable housing options, and this led to an increase in demand for mobile homes and mobile home park rentals. Investors, recognizing the potential for strong cash flow in the mobile home park sector, started to explore these opportunities.

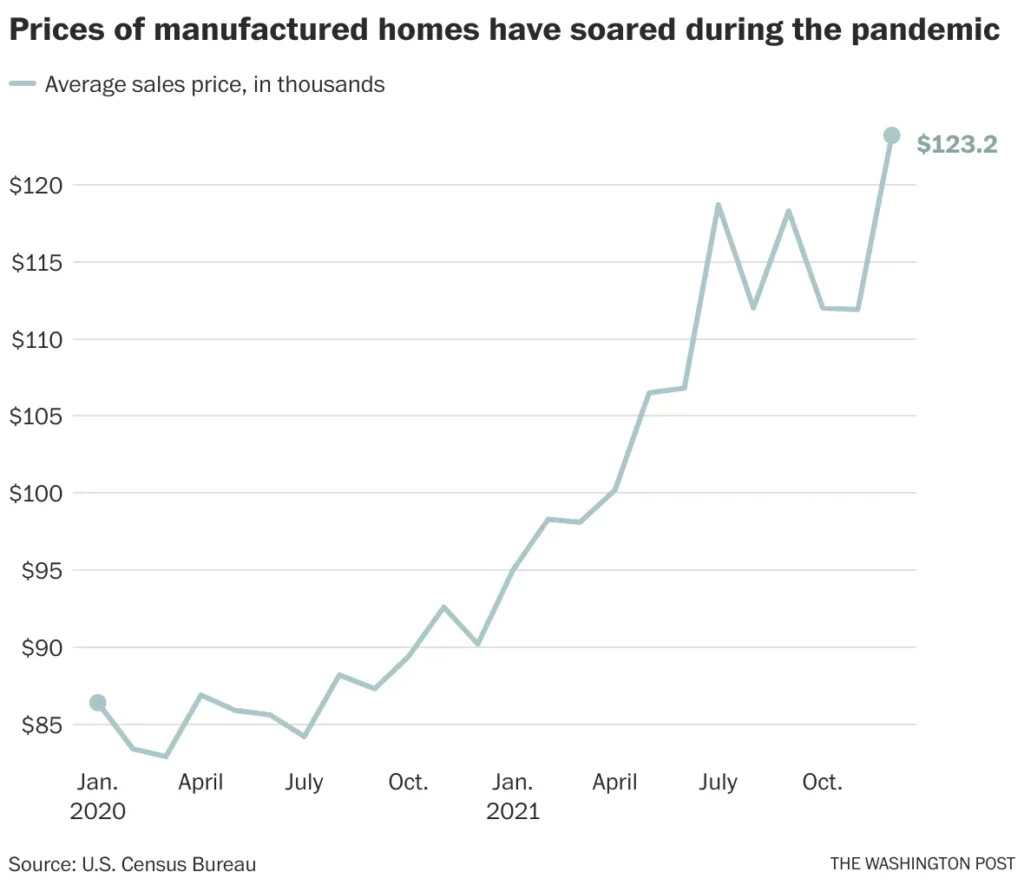

During the COVID-19 pandemic, the prices of new manufactured homes experienced a notable increase. As more individuals and families sought affordable and spacious housing options due to economic uncertainties and remote work opportunities, the demand for mobile homes surged. This heightened demand, coupled with supply chain disruptions and increased construction costs, led to an uptick in mobile home prices. As a result, many prospective buyers faced a more competitive and expensive market during the pandemic, reflecting the broader trend of rising home prices in various housing sectors.

Rent Collections and Financial Stability

The mobile home park industry’s resilience during the pandemic was due to its historical nature as a stable, recession-resistant asset class. As an essential service, mobile home parks continued to operate, and rent collections generally stayed high. This was especially true for mobile home park operators who took proactive steps during the pandemic, by utilizing rental assistance programs, subsidy checks and working to help the residents in their mobile home parks.

Interest Rate Performance During COVID-19

Interest rates play a crucial role in real estate investments, including mobile home parks. The period between 2020-2021 witnessed a significant shift in interest rates, largely influenced by the Federal Reserve’s response to the economic challenges posed by the pandemic.

2020-2021 Interest Rate Trends

During the early months of the pandemic, the Federal Reserve took swift action to combat the economic downturn by lowering interest rates. The federal funds rate, which influences short-term borrowing costs, was reduced to nearly zero. Mortgage rates also experienced a downward trend, hitting historic lows. This created an attractive environment for real estate investors, including those in the mobile home park industry, as borrowing costs became exceptionally affordable.

Present Interest Rate Scenario

As of now, the interest rate environment is beginning to evolve as the economy gradually recovers. The Federal Reserve is closely monitoring inflation and economic growth, and there are expectations of more gradual increases in interest rates over the coming years. While rates remain low in comparison to pre-pandemic levels, investors need to factor in the potential for rising borrowing costs as they make investment decisions in the mobile home park sector.

The Economy in the US

Understanding the broader economic context is essential when assessing the impact of COVID-19 on mobile home park investments.

Economic Recovery

The US economy is in the process of recovering from the pandemic-induced recession. Government stimulus packages, including direct payments to individuals and support for businesses, played a crucial role in stabilizing the economy and supporting consumer spending. As a result, GDP growth rebounded in the latter part of 2020 and continued into 2021.

Learn more about mobile home park investing.

Interested in learning more about mobile home park investing? Get in touch with us today to find out more.

Labor Market

The labor market was severely affected by the pandemic, leading to job losses and economic instability. While unemployment rates reached record highs, there has been a steady recovery in employment. Labor market conditions have improved, but some sectors continue to face challenges in terms of hiring and labor supply.

Inflation

Inflation emerged as a significant concern in the post-pandemic economy. Rising prices for goods and services, driven by supply chain disruptions and increased demand, have led to a notable increase in inflation rates. The Federal Reserve has acknowledged these inflationary pressures and is monitoring them closely.

Measures of longer-term inflation expectations remain within the range of values seen in the decade before the pandemic and continue to be broadly consistent with the FOMC’s longer-run objective of 2 percent, suggesting that high inflation is not becoming entrenched

Federal Reserve

Keel Team’s Performance

Keel Team is a notable player in the mobile home park investment space. Their performance during the COVID-19 pandemic is worth highlighting, as it showcases the resilience and adaptability of seasoned mobile home park operators, and mobile home park investments themselves.

Overall

The Keel Team navigated the challenges presented by the pandemic with resilience and strategic thinking. They recognized the shifting dynamics in the mobile home park market and seized opportunities to expand their portfolio. Coupled with mobile home parks having the tendency to be resilient to inflation and economic downturns, and their experience – the recipe culminated in success during this time.

Collections Stayed High During COVID-19

Keel Team’s proactive approach to resident relations played a pivotal role in maintaining high rent collections during the pandemic. They worked closely with residents, provided payment flexibility when necessary, and actively communicated to address concerns, ultimately ensuring a steady income stream. This resulted in a 96.4% average collection rate across their entire mobile home park portfolio.

Learn more about mobile home park investing.

Interested in learning more about mobile home park investing? Get in touch with us today to find out more.

COVID-19 Rental Assistance Programs

Keel Team also took advantage of rental assistance programs which not only helped residents who faced financial hardship, but also provided a source of stable income for Keel Team. This further boosted their financial stability during this time of economic volatility.

Subsidy Checks

Some residents received government subsidies that, at times, equated to three months’ worth of rent paid upfront. This influx of funds provided a buffer for the Keel Team, and offered security to the residents and Keel Team’s mobile home park portfolio.

No Major Impacts on Keel Team

Keel Team’s ability to adapt to changing circumstances, in conjunction with their strategic approach to resident relations and government support programs, ensured that they experienced no detrimental effects on their investments during the pandemic. On the contrary, the performance across their mobile home park portfolio increased marginally. This is a testament to the resilience mobile home parks typically possess, and the experience Keel Team has which likely benefits them during these times of economic uncertainty.

17 Mobile Home Park Acquisitions

One of the most impressive feats of the Keel Team during the pandemic was their ability to expand their portfolio. Acquiring 17 mobile home parks between 2020 and 2021 is a testament to their expertise, financial strength, and the favorable investment conditions in the mobile home park asset class during the pandemic.

Check out the Saegertown Case Study – a mobile home park investment we acquired back in 2021, which has subsequently gone full-cycle. As a whole, this project achieved a 54.47% annual cash-on-cash return in a 2 year timeframe.

Conclusion

In conclusion, the COVID-19 pandemic had both challenges and opportunities for mobile home park investments. While the real estate industry faced uncertainties in the supply chain and construction delays, mobile home parks benefited from increased demand for affordable housing options. The historical stability and resilience of the mobile home park sector, along with favorable interest rate conditions, encouraged both investors and operators to thrive in this market.

Keel Team’s performance during the pandemic highlights the potential for success in the mobile home park sector. Their strategic approach to resident relations, utilization of government assistance programs, and ability to expand their portfolio highlight the potential resilience of this asset class and the skillset of seasoned operators, making it possible for other operators and mobile home park investors to potentially follow suit.

As we look to the future, it’s essential for investors in the mobile home park industry to monitor interest rate trends, adapt to evolving market conditions, and consider the broader economic context. By staying informed and flexible, investors can essentially continue navigating the mobile home park investment landscape, with likely success.

Disclaimer:

The information provided is for informational purposes only and should not be considered investment advice, nor a guarantee of any kind. There are no guarantees of profitability, and all investment decisions should be made based on individual research and consultation with registered financial and legal professionals. We are not registered financial or legal professionals and do not provide personalized investment recommendations.

Tristan Hunter - Investor Relations

View The Previous or Next Post

Subscribe Below 👇