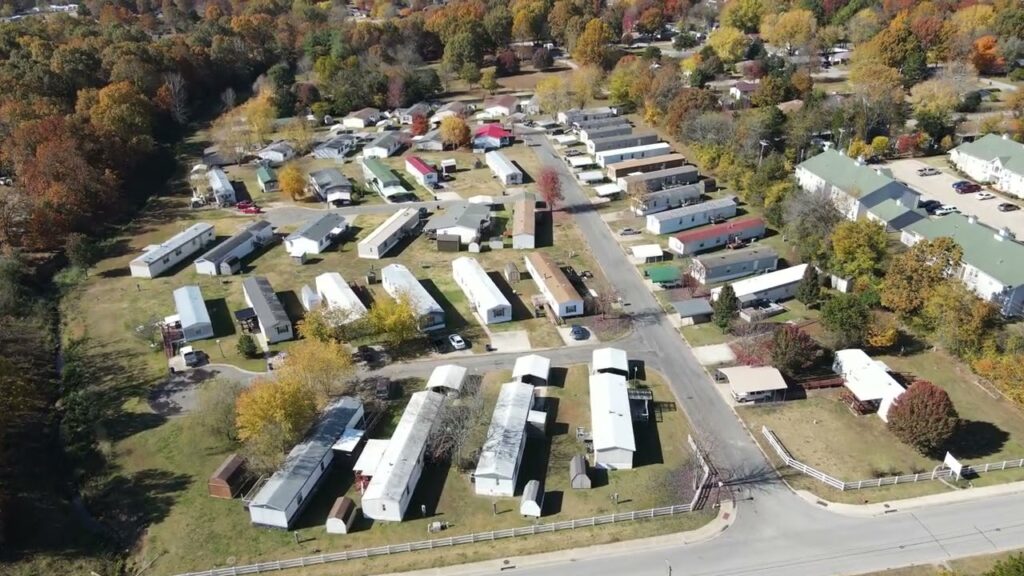

Mobile Home Park Investing: Passive Strategies for Retirement Planning

-

Tristan Hunter - Investor Relations

Tristan Hunter - Investor Relations

When it comes to planning for retirement, many people tend to explore a variety of investment options. One approach that is typically considered, especially for those seeking passive income streams, is investing purely passively in mobile home parks. In this blog post, we will explore potential strategies of how investing passively as a limited partner in mobile home parks will likely benefit you as you plan for retirement. While it’s important to recognize that no investment is without risk, passive mobile home park investing usually offers a unique blend of likely benefits for those looking to secure their financial future and potentially preserve their capital.

Let’s jump right in!

Potential for Steady Cash Flow:

Investing in mobile home parks typically offers the potential for a reliable and steady cash flow. For example, mobile home park tenants typically pay monthly lot rents, providing a consistent source of income for the operators.

The usual demand for affordable housing makes it likely that a steady stream of tenants will be experienced, which is only one of the many factors that may potentially contribute to your financial stability during retirement.

Diversification for Risk Mitigation:

Retirement planning often involves the goal of spreading investments to minimize risk. Passive mobile home park investing can potentially contribute to this diversification.

While no investment is entirely risk-free, mobile home parks often have characteristics that are different from other asset classes, such as stocks or bonds. This diversity can enhance the likelihood of a well-rounded and secure retirement portfolio.

Tax Advantages and Potential Deductions:

Retirement planning generally includes strategies to optimize tax efficiency. Mobile home park investments usually offer various tax advantages, including potential deductions for expenses like depreciation. Offsetting passive income with passive losses can potentially lower your tax liability, while increasing the likelihood of preserving more of your retirement income.

Asset Appreciation Over Time:

While no one can predict the future with certainty, it’s common for real estate investments, including mobile home parks, to appreciate over time depending on the market location of the asset. The potential for property appreciation can add to your retirement planning security, even from a passive investing perspective.

Less Active Involvement:

When planning for retirement, it’s often important to consider how much active involvement you want to maintain. Passive mobile home park investments usually provide the opportunity for the sponsor to execute the business plan, which includes factors like on-site management for example.

Partnering with an experienced operator typically allows for day-to-day operations to be handled without your active involvement. This may include maintenance, rent collection, and tenant relations to name a few. This typically allows you to enjoy the potential benefits of passive income without the day-to-day hassles and headaches of active management.

Long-Term Focus and Stability:

Retirement planning usually involves a long-term outlook. Mobile home park investments typically align with this perspective, offering the likelihood of stable, long-term returns. The steady demand for affordable housing makes it likely that mobile home parks will continue to play a vital role in real estate, affordable housing and therefore retirement planning for the passive investor.

Potential for Scaling Investments:

As you plan for retirement, you may seek opportunities to increase your passive income. Investing in mobile home parks typically offers the potential for scalability. As you accumulate more capital, you will most likely have the opportunity to invest in additional mobile home parks. This scalability can help diversify your retirement income sources further.

Local Market Dynamics Impact:

It’s important to recognize that local market dynamics usually impact the performance of mobile home park investments. Retirement planning should take into account the likely stability of the market where your investment is located. Factors like population growth, employment opportunities, and the demand for affordable housing are a few factors that will most likely influence the performance of your investment.

Exit Strategies and Flexibility:

Retirement planning often involves considering exit strategies. Whether you plan to retire in stages or simply want to ensure a flexible approach to your investments, mobile home park investments usually provide various options.

A common exit strategy involves the sale of the property, where your initial investment will be likely returned.

Niche operators like Keel Team, prefer alternatives methods for the potential return on investment– the Buy and Hold Model being a method that they specialize in. This tends to be perfect for investors with the goal of staying in a long-term investment. Generally speaking, this allows you to enjoy the likely share of equity that can be added to your passive income stream as you gear up for retirement.

Learn more about mobile home park investing.

Interested in learning more about mobile home park investing? Get in touch with us today to find out more.

Wrapping It Up:

In conclusion, when it comes to retirement planning, exploring passive strategies like investing in mobile home parks can provide a unique set of potential benefits. The likely steady cash flow, diversification opportunities, minimal active involvement required, and potential for tax advantages like depreciation; typically make this form of investment an attractive option.

However, it’s essential to conduct thorough research, understand market dynamics, and seek professional advice to ensure that your mobile home park investment aligns with your retirement goals and financial needs.

Stay tuned for more passive mobile home park investing guidelines, which I hope will help you on your real estate investment journey, and potentially benefit you on your path to a relaxed and financially secure retirement!

Disclaimer:

The information provided is for informational purposes only and should not be considered investment advice, nor a guarantee of any kind. There are no guarantees of profitability, and all investment decisions should be made based on individual research and consultation with registered financial and legal professionals. We are not registered financial or legal professionals and do not provide personalized investment recommendations.

Tristan Hunter - Investor Relations

View The Previous or Next Post

Subscribe Below 👇