Why Passive Mobile Home Park Investing Is Generally Better Than Other Forms Of Investment

-

Tristan Hunter - Investor Relations

Tristan Hunter - Investor Relations

With the rise of the popularity of mobile homes, several of the biggest private equity firms are acquiring mobile home parks for their unique performance qualities.

Mobile homes are generally considered an affordable alternative in comparison to traditional single family housing options. Investing passively in a mobile home park can be a great opportunity for investors aiming for steady passive income.

In this post, we’ll discuss why investing passively as a limited partner in a mobile home park syndication is typically a great investing alternative.

Let’s dive in!

Why Passive Mobile Home Park Investing Can Be A Great Investment?

Mobile home parks are a great option for investors looking for potentially low-risk passive investments with steady cash flow. Here are a few reasons why mobile home parks are a great passive investment:

High Demand

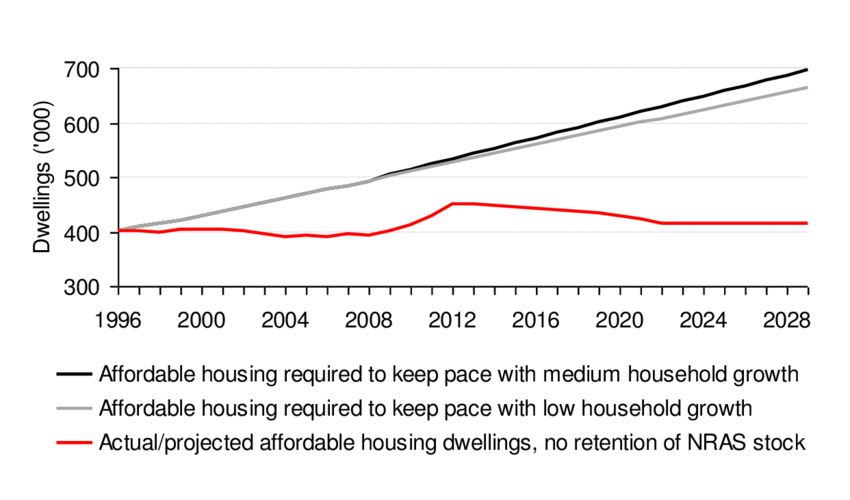

Mobile homes have grown in demand in recent years for their incredible affordability compared to traditional housing options. The demand for affordable housing is constantly rising, and with the next recession knocking on the door, this demand may only escalate further.

With the current economic state, low-income individuals tend to gravitate towards mobile homes rather than small low-rent apartments. This creates a lot of opportunity to potentially plug the gap in the market, whilst simultaneously tackling the affordable housing crisis.

Low Supply

Despite having such high demand, the supply doesn’t quite match the same level. The demand may increase further during this economic downturn, with the supply, at this stage, unable to match such high demand. As we learned in Econ 101, this provides a unique opportunity to potentially capitalize on these market conditions. New mobile home park developments are very hard to get approved through zoning boards because many local residents come out and vote against living near a “trailer park.”

Mobile Home Parks Have Low Tenant Turnover

While mobile homes are meant to be easily transportable, they aren’t necessarily intended to be moved frequently. Moving a mobile home from one location to another can cost around $5,000. After a mobile home owner moves to a new park, they tend to stay there for many years because of the high costs associated with transporting and moving a mobile home. In the rare instance that they do move, they generally look to sell their home as a cheaper alternative to this. This gives the opportunity for new potential tenant owners to fill the mobile home.

Unlike apartment complexes, which typically have a high-turnover rate (around 40-50% annually), mobile home parks historically have had a low-tenant turnover rate (around 5-10% annually on tenant owned homes).

Mobile Home Parks Are Low Volatility

Mobile home parks are typically low risk investments. They’re also known for possessing recession and inflation-resistant characteristics. Due to their on-going high demand, they tend to produce a steady, predictable cash flow even during times of market volatility. Furthermore, their performance generally isn’t dependent on other real estate sectors, or the performance of the stock market.

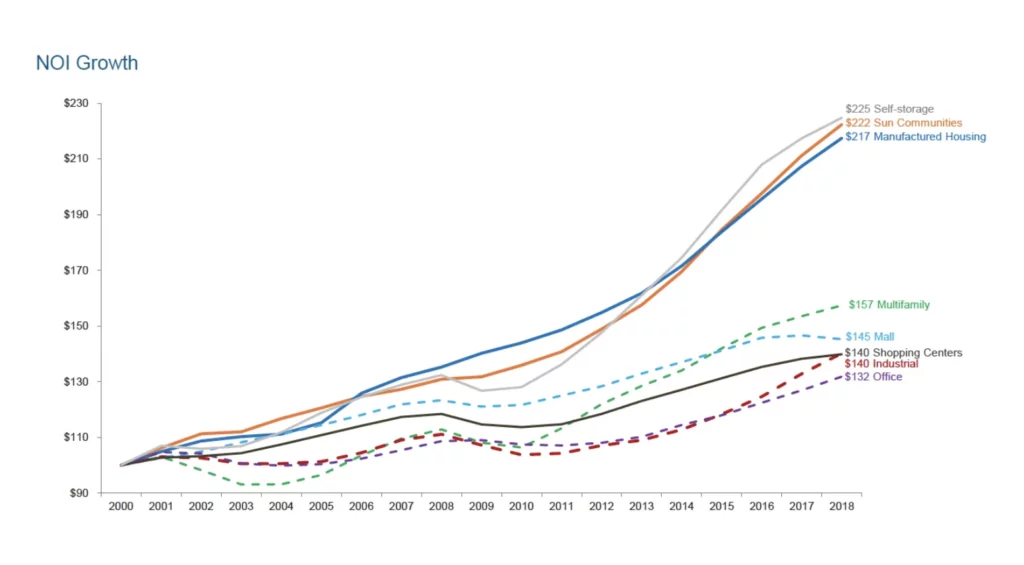

Higher Returns for Passive Mobile Home Park Investing

Mobile home parks typically have higher cash-on-cash returns compared to other Multi-family real estate asset classes. One reason for this is because mobile home parks tend to have lower operating expenses compared to traditional multi-family properties. This is because the mobile home park owner is usually responsible for the upkeep of the infrastructure and common areas. Furthermore, the individual residents who own their mobile home are responsible for repairs and maintaining them. As a result, the mobile home park owner can potentially save on maintenance and repair costs. This increases the overall net operating income (NOI) and boosts returns.

How To Invest In Mobile Home Parks?

There are a number of ways to invest in mobile home parks. From joint ventures to direct ownership, syndications, REITS, funds and many other options- the question is, where do you start?

The strategy that we enjoy at Keel Team is investing through once-off, per project syndications. This encompasses the long-term goal of holding the property for potential cash-flow into perpetuity.

Mobile home park syndications involve a group of investors pooling their funds to collectively purchase and operate a mobile home park. In this model, there’s typically a lead sponsor or operator who manages the property and executes the business plan. This allows the opportunity for investors to invest passively as a limited partner. It’s important to note that these are investments and there is not a guarantee of a positive return on such investment.

Let’s Talk

Get in touch with us to learn more about mobile home park investing today!

Benefits of Passive Mobile Home Park Investing Through Syndications

Syndication mobile home park investing can be a great source of passive income, especially when you partner with the right operator, with a proven track record. Some of the benefits include:

- Access to deals. Professional sponsors have access to mobile home park deals that are not easy to come by. These are typically sourced off-market, direct to the owner by a team of designated sales representatives that syndication sponsors hire in house.

- Low time commitment. Investing in mobile home parks passively typically allows you to enjoy passive income while the operator executes the business plan and deals with the tenants, toilets and trash.

- Diversification. Mobile home parks allow the opportunity to diversify your investment portfolio into an alternative investment that supports maintaining affordable housing.

- Tax benefits. Mobile home parks currently follow an accelerated depreciation schedule, which typically allows investors to reduce their taxable income. Investors can also save on taxes using common commercial real estate tools like the 1031 exchange.

To Wrap It Up

Many are starting to realize that mobile home parks are a great alternative investment for investors based on historical performance. It also provides the perfect opportunity for those looking to get away from the stock market, or the Wall Street Casino as I like to call it, and into more hopefully predictable investments. The great news is that there is still plenty of opportunity in the mobile home park market. Stay tuned for more passive mobile home park investing guidelines from this blog – which I hope will help you on your real estate investing journey!

Tristan Hunter - Investor Relations

View The Previous or Next Post

Subscribe Below 👇