Mobile Home Park REIT Investing: Quarterly Summary – Q3 2024

-

Tristan Hunter - Investor Relations

Tristan Hunter - Investor Relations

Introduction

The mobile home park REIT investing landscape has shown consistent resilience, even during volatile economic cycles. Mobile home parks form the foundation of affordable housing. They continue attracting attention from investors seeking stability and long-term growth. The four largest publicly traded REITs—Sun Communities (SUI), Equity LifeStyle Properties (ELS), UMH Properties (UMH), and Flagship Communities REIT (FLGMF)— typically dominate this niche. These companies offer valuable insights into the sector’s performance and future trajectory through their quarterly reports.

This blog examines their Q3 2024 performance. It highlights key metrics like occupancy rates, lot rent growth, and portfolio developments. By analyzing these metrics, we can understand the unique positioning of these mobile home park REIT investing companies. Whether you’re an experienced investor or exploring this asset class for the first time, these insights are aimed at helping you make informed decisions.

Check out the video summary below!

Sun Communities, Inc.

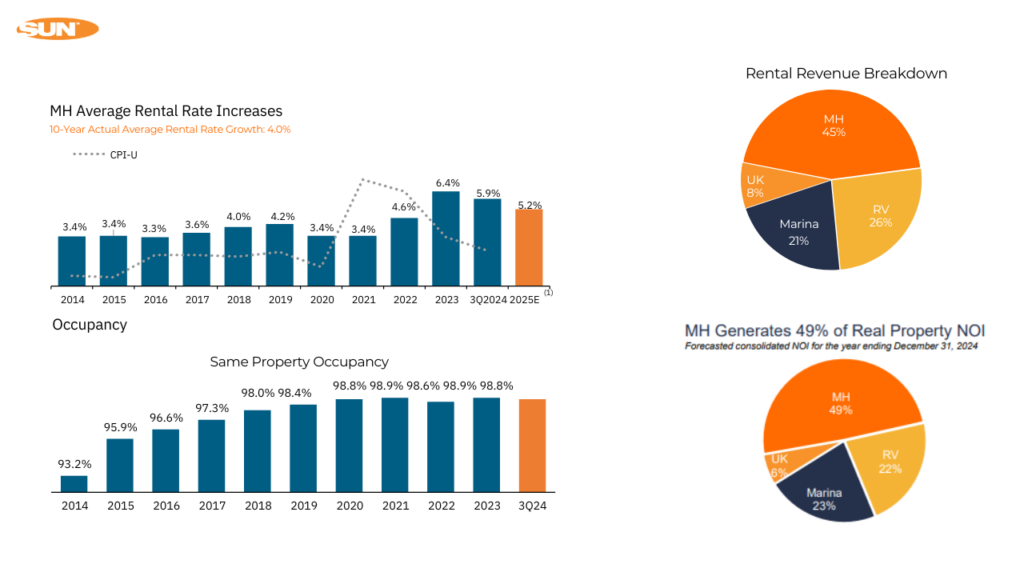

Sun Communities, Inc. (SUI) reported solid performance in Q3 2024, showcasing its resilience as a leader in manufactured housing and RV communities.

Financial Performance

- Net Operating Income (NOI): NOI reached $158.3 million, a 4.6% increase from the same quarter last year ($151.3 million). This growth is attributed to rent increases across properties.

- Stock Price: The stock price rose to $135.15 at the end of Q3 2024, reflecting a 13.9% increase year-over-year ($118.34 in Q3 2023).

Operational Highlights

- Occupancy Rates: Current occupancy stands at 97.3%, a slight improvement from 97.2% in the previous quarter and 96.8% in the same quarter last year.

- Lot Rents: Average lot rent increased to $701 this quarter, up from $692 in Q2 2024 and $662 in Q3 2023. This reflects sustained demand and inflation-driven adjustments.

- Revenue-Producing Sites: MH and RV revenue-producing sites grew by approximately 2,500 year-to-date, slightly down from 2,590 during the same period in 2023.

Portfolio Updates

- Portfolio Size: The total number of lots remained stable at 283,000, though the focus has shifted to investing in marinas, slightly reducing mobile home park-specific investments.

- Recent Activity: The company continues to expand through targeted acquisitions and site development. In Q1 2024, it sold two operating communities and expanded others, demonstrating a balanced approach to portfolio optimization.

Strategic Highlights

- Focus on Transitioning RV Sites: Transient-to-annual RV site conversions accounted for 79% of site growth in 2024, reflecting a strategy to enhance revenue stability.

- Infrastructure Investments: Ongoing investments in infrastructure, including utility and amenity upgrades, have supported tenant satisfaction and operational efficiency.

Sun Communities has shown consistent growth in NOI, lot rents, and occupancy rates over the past 12 months. Compared to other asset classes, its focus on affordable housing has helped maintain stability during economic uncertainties. The company remains poised for further success through strategic investments and operational efficiency.

View the full quarterly report HERE!

Click HERE for the latest investor presentation.

Download our FREE eBook on the Top 10 things to know BEFORE investing passively in mobile home parks!

Equity LifeStyle Properties

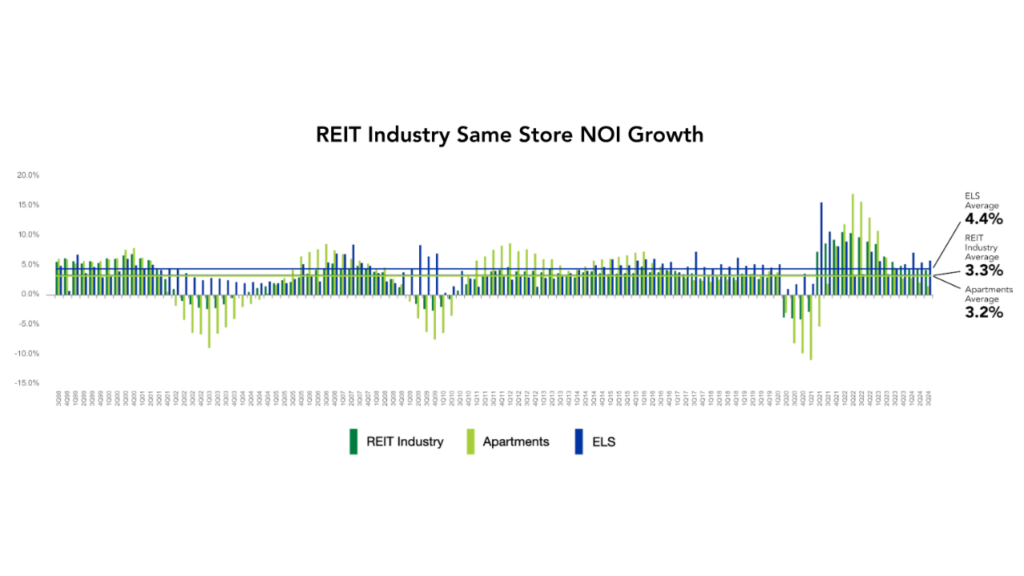

Equity LifeStyle Properties, Inc. (ELS) reported a steady Q3 2024 performance, highlighting continued growth in its manufactured housing (MH) and RV community portfolio.

Financial Performance

- Net Operating Income (NOI): NOI reached $178.3 million in Q3 2024, a 6.2% increase compared to $167.9 million in Q3 2023, driven by rent increases and slight occupancy gains.

- Stock Price: The stock closed at $70.76 at the end of Q3 2024, reflecting a 6.8% increase from Q3 2023’s close of $63.53, showcasing positive investor sentiment.

- Rental Income Growth: Core MH base rental income grew by 6.2%, reflecting a 5.8% increase from rate adjustments and 0.4% from occupancy gains.

Operational Highlights

- Occupancy Rates: Current MH occupancy is stable at 94.6%, consistent with the same quarter last year and slightly up from 94.4% in Q2 2024.

- Lot Rent: Average lot rent increased to $861 in Q3 2024, up from $854 in Q2 2024 and $813 in Q3 2023. This 5.9% year-over-year growth reflects inflationary adjustments and strong demand.

Portfolio Activity

- Lot Ownership: ELS owned 73,006 lots in Q3 2024, up from 72,736 in Q3 2023, indicating modest portfolio expansion.

- New Home Sales: The company sold 173 new homes during Q3 2024, with an average sales price of $88,000, compared to 285 homes in Q3 2023.

- Site Gains: Core MH homeowners increased by 111 during the quarter, and transient-to-annual RV site conversions contributed to revenue stability.

Strategic Highlights

- Growth from Rate Adjustments: Rent increases remain the primary driver of revenue growth, with consistent demand in key markets like Florida, California, and Arizona.

- Development Pipeline: ELS continues to expand its MH footprint, with more than 1,000 sites under development in key markets.

- Resilience in Key Metrics: ELS’s focus on maintaining stable occupancy and strategic rate adjustments positions it well amid rising costs.

Equity LifeStyle Properties has sustained strong financial performance over the past year, with steady growth in rental income and NOI. While new home sales volumes have decreased compared to 2023, rent increases have bolstered overall revenue. The company’s ability to balance portfolio expansion with operational efficiency suggests continued stability and growth potential in the coming quarters.

View the full quarterly report HERE!

Click HERE for the latest investor presentation.

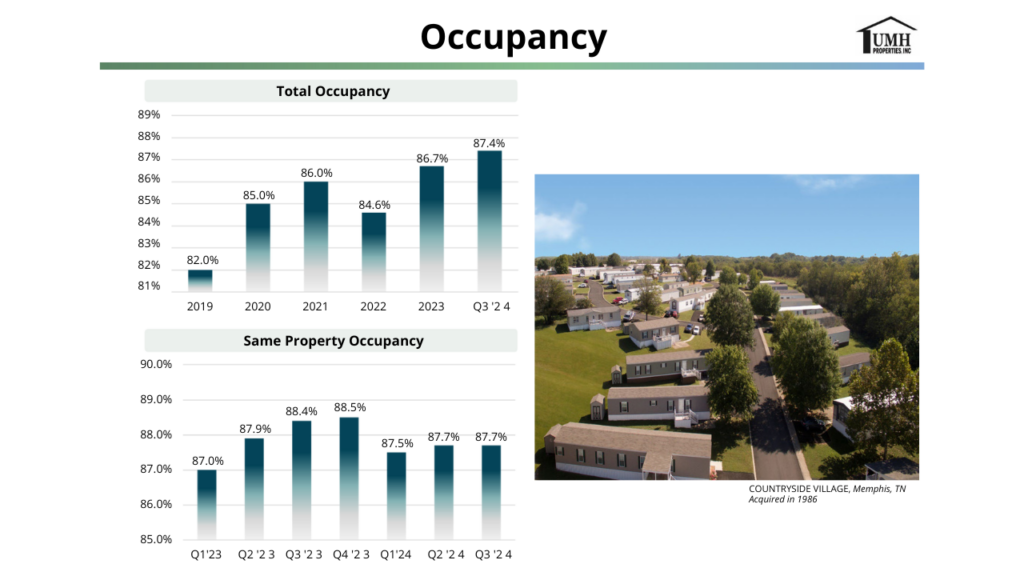

UMH Properties, Inc.

UMH Properties reported strong performance in Q3 2024, marked by strategic growth initiatives and steady improvements in its operational metrics.

Financial Performance

- Net Operating Income (NOI): Community NOI increased by 7% year-over-year, driven by steady rental income growth and operational efficiency.

- Stock Performance: UMH’s stock closed at $19.67 at the end of Q3 2024, a significant increase from $14.02 in Q3 2023, reflecting positive market sentiment.

- Revenue Growth: Total income for the quarter saw a 10% year-over-year increase, attributed to higher rental income and lot rent growth.

Operational Highlights

- Occupancy Rates: Current portfolio occupancy stands at 87.4%, slightly down from 88.5% in the previous quarter but stable compared to 86.7% in Q3 2023.

- Lot Rent: Average lot rent held steady at $534, reflecting year-over-year growth driven by inflationary pressures and supply-demand dynamics.

Portfolio Expansion

- Number of Lots Owned: UMH owns 26,200 lots as of Q3 2024, up from 25,405 in Q3 2023, reflecting its commitment to growth.

- Acquisitions: UMH increased its rental home portfolio by 117 homes during Q3 2024, bringing the total to approximately 10,300 rental homes, a 3% year-to-date increase.

- New Developments: UMH continues to invest in new community developments, including projects in partnership with Nuveen Real Estate.

Strategic Highlights

- Rental Home Growth: The addition of rental homes contributed to NOI growth and improved the company’s competitive positioning in the manufactured housing space.

- Operational Efficiency: UMH maintained a strong focus on expense management, supporting NOI growth and margin expansion.

- Geographic Expansion: The company acquired its first community in Georgia, further diversifying its portfolio geographically.

UMH demonstrated consistent improvement over the past year, with NOI and income showing steady growth. The company’s expansion strategy, combined with disciplined expense management, has positioned it well for continued success. UMH’s focus on increasing rental homes and expanding geographically suggests ongoing growth potential in the manufactured housing sector.

View the full quarterly report HERE!

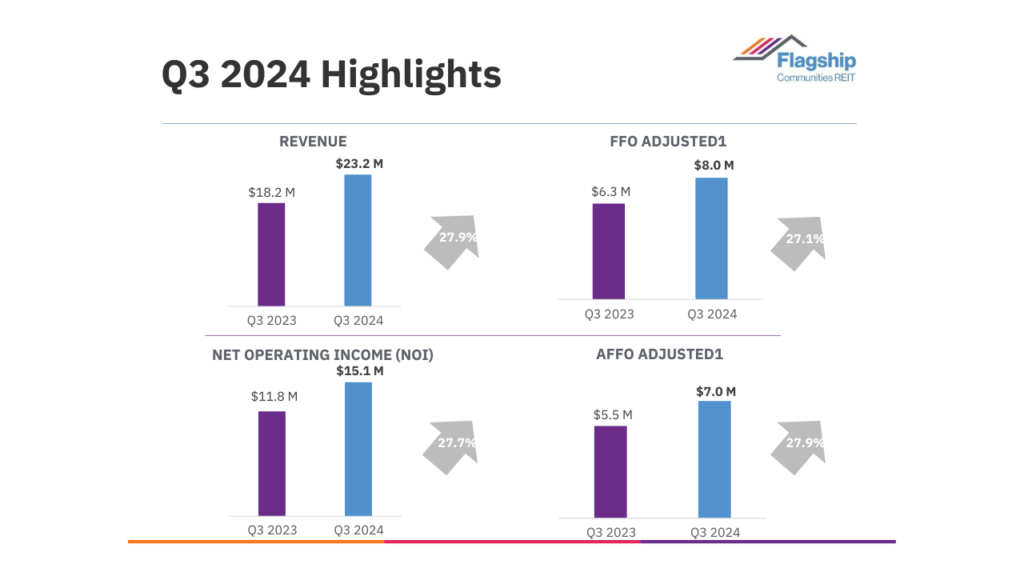

Flagship Communities REIT

Flagship Communities REIT (FLGMF) reported notable growth and operational advancements in Q3 2024, underscoring its commitment to strategic expansion and portfolio optimization.

Financial Performance

Stock Performance: The stock closed at $15.19 at the end of Q3 2024, slightly up from $15.00 in Q3 2023, reflecting investor confidence in the REIT’s long-term strategy.

Net Operating Income (NOI): Q3 NOI reached $15.1 million, a 27.7% increase compared to $11.8 million in Q3 2023, demonstrating strong revenue growth and operational efficiency.

Operational Highlights

- Occupancy Rates: Current occupancy stands at 84.4%, up from 83.9% in the previous quarter and 83.4% in the same quarter last year. This growth highlights successful infill strategies.

- Portfolio Size: Flagship expanded its portfolio significantly, with the number of lots owned rising to 15,138 in Q3 2024, compared to 12,743 in the previous quarter. This growth reflects recent acquisitions and expansion projects.

- Same Community Expansions: The REIT added 81 additional lots in the Louisville, Kentucky MSA during Q2 2024. Although this caused a slight dip in short-term occupancy, it boosts long-term potential.

Strategic Highlights

- Acquisitions: Recent acquisitions include a community in Evansville, Indiana, for $23 million, and a resort-style community in Lakeview, Ohio, for $3 million.

- Operational Efficiency: Rent collections for the quarter remained strong at 99.3%, up from 98.2% in Q3 2023, indicating effective tenant management.

- Focus on Growth Markets: The REIT continues to target high-demand areas, including Kentucky, Indiana, and Ohio, delivering stable returns and growth potential.

Comparison to Historical Performance

Flagship’s consistent occupancy gains and NOI growth over the past year demonstrate its focus on operational efficiency and strategic expansion. By maintaining strong rent collections and expanding its footprint in key markets, Flagship Communities REIT has cemented its position as a rising player in the manufactured housing industry.

Outlook

Flagship’s focus on portfolio expansion and operational excellence underscores its potential for long-term growth. With high rent collection rates, strategic acquisitions, and infill initiatives, the REIT is well-equipped to navigate market challenges and capitalize on future opportunities.

View the full quarterly report HERE!

Click HERE for the latest investor presentation.

Conclusion

The Q3 2024 performance of the four leading manufactured housing REITs highlights the strength of mobile home park REIT investing. Sun Communities showed consistent growth in NOI and lot rents, reflecting its stability as a leader. Equity LifeStyle Properties balanced modest portfolio expansion with steady income growth, demonstrating operational efficiency. UMH Properties focused on strategic geographic diversification and rental homes to boost efficiency. Flagship Communities excelled in aggressive portfolio expansion and successful infill strategies.

Rising lot rents, stable occupancy rates, and strong NOI growth showcase the typical resilience of mobile home parks. By managing costs, expanding portfolios, and adapting to market shifts, these mobile home park REIT investing companies position themselves as reliable players in the real estate landscape.

For investors seeking both stability and growth, mobile home parks typically provide distinct advantages. As these REITs continue innovating and expanding, they reinforce the enduring value of affordable housing in today’s economy. Stay tuned for updates as we monitor their performance and track trends in this historically resilient industry!

Are you looking for MORE information? Book a 1-on-1 consultation with Andrew Keel to discuss:

- A mobile home park deal review

- Due diligence questions

- How to raise capital from investors

- Mistakes to avoid, and more!

Disclaimer:

The information provided is for informational purposes only, therefore, it should not be considered investment advice or a guarantee of any kind. Additionally, we do not guarantee profitability under any circumstances. Before making any investment decisions, it is essential to conduct thorough research and consult with registered financial and legal professionals. Furthermore, we are not registered financial or legal professionals, nor do we provide personalized investment recommendations.

Tristan Hunter - Investor Relations

View The Previous or Next Post

Subscribe Below 👇