Mobile Home Park REIT Investing: Quarterly Report Summary for Q2 of 2024

-

Tristan Hunter - Investor Relations

Tristan Hunter - Investor Relations

Introduction to Mobile Home Park REIT Investing

Mobile home park REIT investing remains a strong focus for investors, especially as economic conditions heighten the demand for affordable housing. In this quarterly analysis, we review the Q2 2024 performance of four major mobile home park REITs – Sun Communities (SUI), Equity LifeStyle Properties (ELS), UMH Properties (UMH), and Flagship Communities REIT (FLGMF). We explore key metrics, including their stock price performance, Net Operating Income (NOI), occupancy rates, lot rent growth, and acquisitions, to help provide insights into their ongoing trends and future outlooks.

Watch the video above for a quick overview of these top-performing REITs!

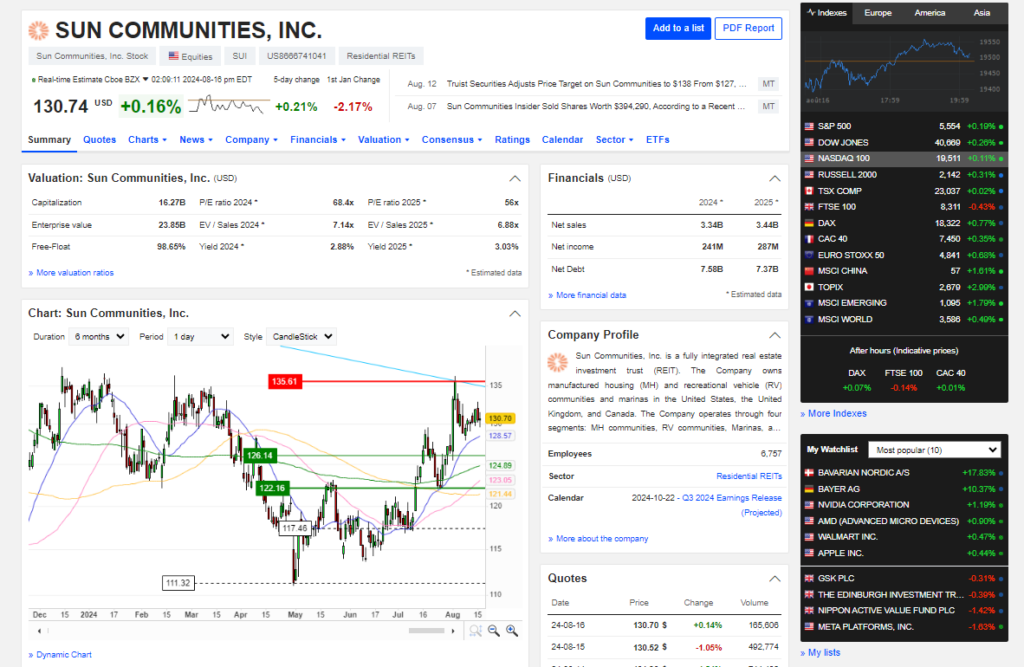

Mobile Home Park REIT Investing Quarterly Performance: Sun Communities (SUI)

Stock Price Performance

Sun Communities’ stock price slightly declined during Q2 2024, closing at $118.76, down from $122.27 in Q1 2024. This drop continues a broader trend over the past 12 months, with the stock priced at $130.46 in June 2023. Factors contributing to this decline may include broader market conditions, investor sentiment, and specific company developments.

Net Operating Income (NOI)

Despite the drop in stock price, Sun Communities saw growth in its Net Operating Income (NOI) for Q2 2024. The NOI for this quarter reached $160.7 million, down slightly from $162.2 million in Q1 2024. However, compared to Q2 2023’s $151.3 million, the company showed year-over-year growth. This increase is largely due to higher lot rents, which rose by 6.4% over the past year, driven by inflation and strong demand in the affordable housing sector.

Occupancy Rates

Sun Communities maintained a stable occupancy rate of 97.2% during Q2 2024, matching the previous quarter and slightly up from 96.8% in Q2 2023. This stability is crucial, as it directly impacts rental income and overall financial performance. The high occupancy rate reflects the ongoing demand for affordable housing and the company’s ability to retain tenants.

Lot Rent Growth

Lot rent growth has been a significant driver of Sun Communities’ financial performance. In Q2 2024, the average lot rent increased to $692, up from $686 in the previous quarter and $653 in Q2 2023. This 6.4% year-over-year increase is driven by inflationary pressures and strong demand, allowing the company to pass on costs to tenants while maintaining high occupancy rates.

Portfolio and Acquisitions

Sun Communities showed stability in its portfolio size, reporting 291 properties in Q2 2024, the same as in the previous quarter and last year. However, the company has shifted its focus toward diversifying its portfolio by investing in marinas instead of expanding its mobile home park holdings. This strategic move may explain the slight downward trend in the number of lots owned, which increased marginally from 99,130 in Q1 2024 to 99,390 in Q2 2024.

In Q1 2024, Sun Communities sold two operating communities in Florida and Arizona, consisting of 533 developed sites, for approximately $51.7 million. This sale resulted in a gain of $6.2 million. Additionally, the company expanded one existing community by 30 sites and delivered 70 new sites at a ground-up development property. These activities reflect the company’s strategy to optimize its portfolio while exploring opportunities in related sectors like marinas.

Summary

Sun Communities, Inc. continues to perform solidly in the mobile home park sector, with stable occupancy rates, growth in lot rents, and a strategic focus on portfolio diversification. Despite a decline in stock price, the company’s NOI has shown positive growth year-over-year, driven by increased rents and strong demand for affordable housing.

Q3 2024 will be crucial in monitoring how Sun Communities manages its portfolio, especially with its recent focus on marina investments. The company’s ability to maintain high occupancy rates and continue growing its NOI will be key indicators of its ongoing success in the REIT space.

View the Quarterly Report Here!

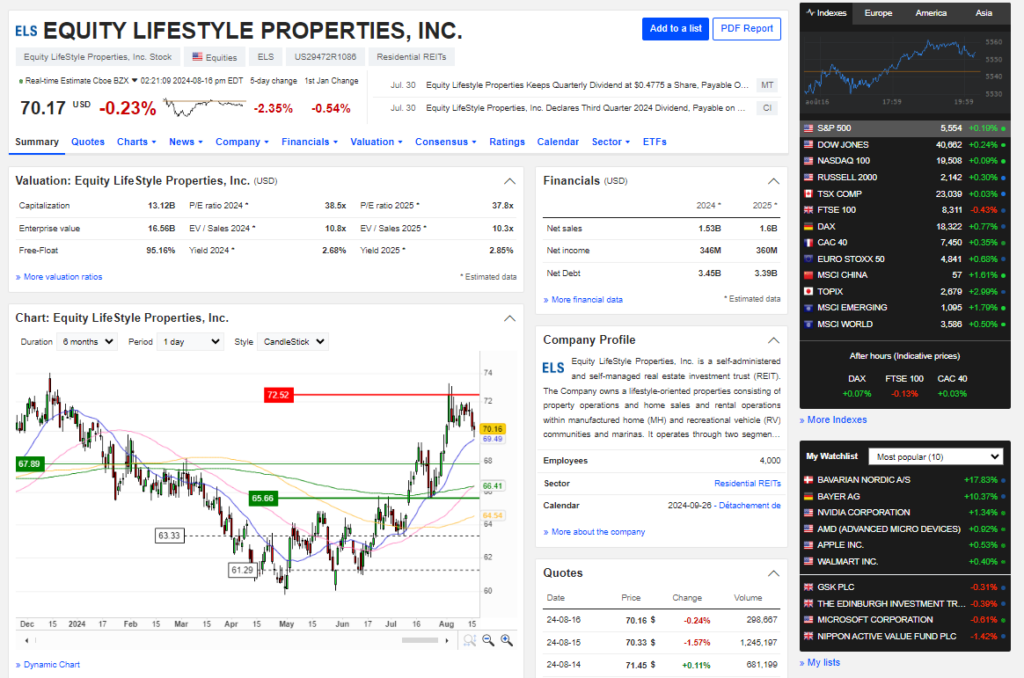

Mobile Home Park REIT Investing Quarterly Performance: Equity Lifestyle Properties (ELS)

Stock Price Performance

Equity LifeStyle Properties saw a slight increase in its stock price during Q2 2024, closing at $64.60, up from $64.17 in Q1 2024. Compared to the same period last year, where the stock price was $66.89 at the end of June, this marks a minor decline over the 12-month period. However, the trend over the last quarter shows a stable and slightly upward movement, indicating a positive investor outlook amid the broader market conditions.

Net Operating Income (NOI)

ELS reported a solid performance in Q2 2024 with rental income reaching $176.7 million. While this represents a decline from the $211.4 million recorded in Q1 2024, it still shows an improvement over the same quarter in the previous year, where rental income stood at $166.4 million. The upward trend in NOI over the last 12 months reflects the company’s successful implementation of rent increases and its ability to manage operational costs effectively.

Occupancy Rates

The occupancy rate for ELS remained stable at 94.4% in Q2 2024, consistent with the previous quarter. However, this is a slight decrease from the 94.6% occupancy rate reported in the same quarter of the previous year. The minor drop in occupancy can be attributed to the company’s ongoing expansion efforts, which have introduced new homes into the market. As these new sites become occupied, occupancy rates are expected to stabilize or even increase in future quarters.

Lot Rent Growth

Lot rent growth has been a key driver of revenue for ELS. In Q2 2024, the average lot rent increased to $854, up from $847 in the previous quarter and $806 in Q2 2023. This represents a 6.8% increase over the last 12 months, primarily driven by inflationary pressures and strong demand for affordable housing. The consistent rise in lot rents underscores ELS’s ability to adapt to market conditions and capitalize on the high demand within the mobile home park sector.

Portfolio and Acquisitions

Equity LifeStyle Properties has shown steady growth in its portfolio size. As of Q2 2024, the company owned 73,006 lots, a slight decrease from the 73,008 lots in the previous quarter but an increase from 72,717 lots in the same quarter last year. The overall trend in portfolio size over the last 12 months has been upward, reflecting the company’s strategic focus on expanding its presence in key markets.

During Q1 2024, ELS reported a significant increase in core MH base rental income, driven by a 6.4% growth compared to the same period in 2023. The company also added 123 new homeowners since December 31, 2023, and sold 191 new homes during Q1 2024 at an average sales price of $93,000. These metrics highlight ELS’s strong performance in maintaining and expanding its core portfolio, particularly in high-demand areas like Florida, California, and Arizona.

Summary

Equity LifeStyle Properties, Inc. continues to perform robustly in the mobile home park REIT sector, with steady growth in lot rents, a stable occupancy rate, and a gradually expanding portfolio. Despite a minor dip in stock price over the last 12 months, the company’s financial metrics, such as NOI and rental income, show positive trends, indicating effective management and strategic growth initiatives.

Investors should keep an eye on ELS’s ability to maintain its high occupancy rates while integrating new sites into its portfolio. The company’s consistent rent growth and strategic expansion efforts position it well for continued success in the mobile home park sector.

View the Quarterly Report Here!

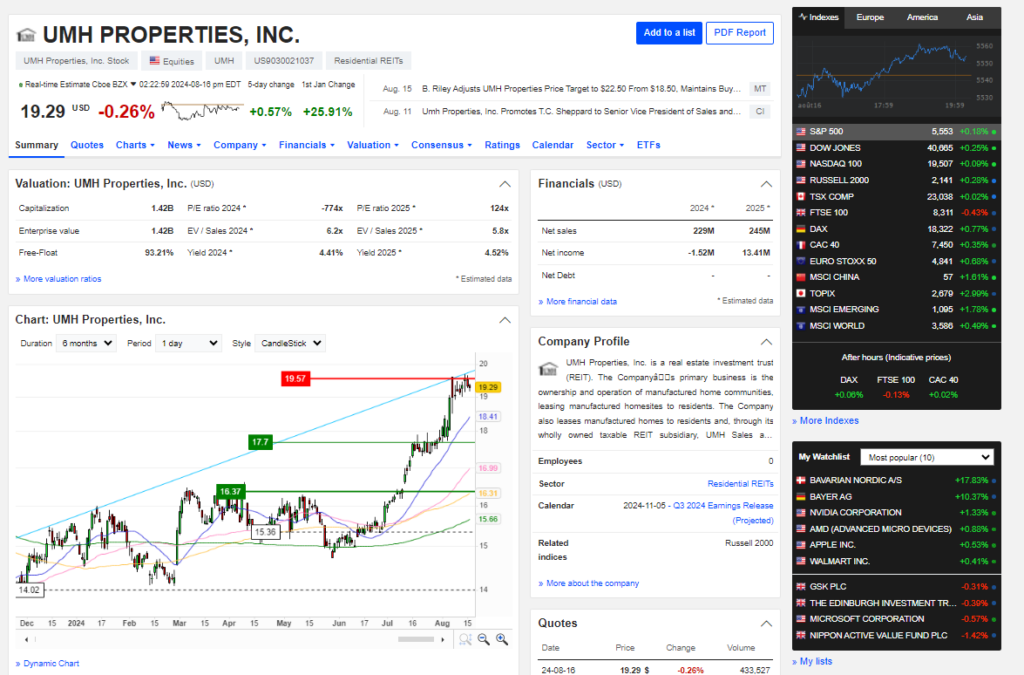

Mobile Home Park REIT Investing Quarterly Performance: UMH Properties (UMH)

Stock Price Performance

UMH Properties’ stock price showed a slight increase during Q2 2024, closing at $16.04, up from $15.84 in Q1 2024. This is a modest gain, but when compared to the same period last year, where the stock price stood at $15.98 at the end of June, it reflects an overall upward trend over the past 12 months. The gradual rise in stock price indicates steady investor confidence, supported by the company’s solid operational performance.

Net Operating Income (NOI)

UMH reported a strong increase in Net Operating Income (NOI) for Q2 2024, reaching $30.9 million, up from $27.9 million in the same quarter of the previous year. This upward trend in NOI is consistent with the company’s recent financial performance, which has been bolstered by effective rent increases and the expansion of its rental home portfolio. In Q1 2024, the company also reported a 16% increase in community NOI, further highlighting the positive impact of its strategic growth initiatives.

Occupancy Rates

The occupancy rate for UMH Properties experienced a slight decline in Q2 2024, dropping to 87.7% from 88.5% in the previous quarter. However, this is still an improvement from the 86.4% occupancy rate reported in the same quarter last year. The decrease in occupancy from Q1 to Q2 2024 can be attributed to the ongoing expansion efforts and the introduction of new homes, which temporarily impacted the overall occupancy rate. As these new sites are filled, occupancy rates are expected to stabilize or improve in the coming quarters.

Lot Rent Growth

Lot rent growth continues to be a significant driver of revenue for UMH. In Q2 2024, the average lot rent increased to $534, up from $524 in the previous quarter and $509 in Q2 2023. This 4.9% year-over-year increase in lot rent is primarily driven by inflationary pressures and the strong demand for affordable housing, which allows UMH to implement rent hikes while maintaining competitive occupancy rates.

Portfolio and Acquisitions

UMH Properties has shown a stable and slightly growing portfolio. As of Q2 2024, the company owned 25,475 lots, consistent with the previous quarter and slightly up from 25,405 lots in the same quarter last year. This growth reflects the company’s strategic acquisitions and expansions, including the addition of a new community totaling approximately 100 sites. UMH’s focus on expanding its portfolio across various states, including Alabama, Georgia, Indiana, and others, has contributed to its steady growth in portfolio size.

In Q1 2024, UMH reported significant achievements, including a 10% increase in total income compared to the same period in 2023. The company also expanded its rental home portfolio by 245 homes during the quarter, reflecting an ongoing commitment to providing affordable housing solutions across its communities.

Summary

UMH Properties, Inc. continues to demonstrate strong performance in the mobile home park sector, with steady growth in lot rents, an increasing NOI, and a slightly expanding portfolio. Despite a minor dip in occupancy rates due to expansion efforts, the company’s overall financial health remains robust, supported by strategic acquisitions and consistent rent growth.

Investors should monitor UMH’s ability to fill new sites and maintain its growth trajectory in terms of NOI and portfolio size. The company’s ongoing focus on expanding its rental home portfolio and strategic acquisitions positions it well for continued success in the mobile home park REIT space.

View the Quarterly Report Here!

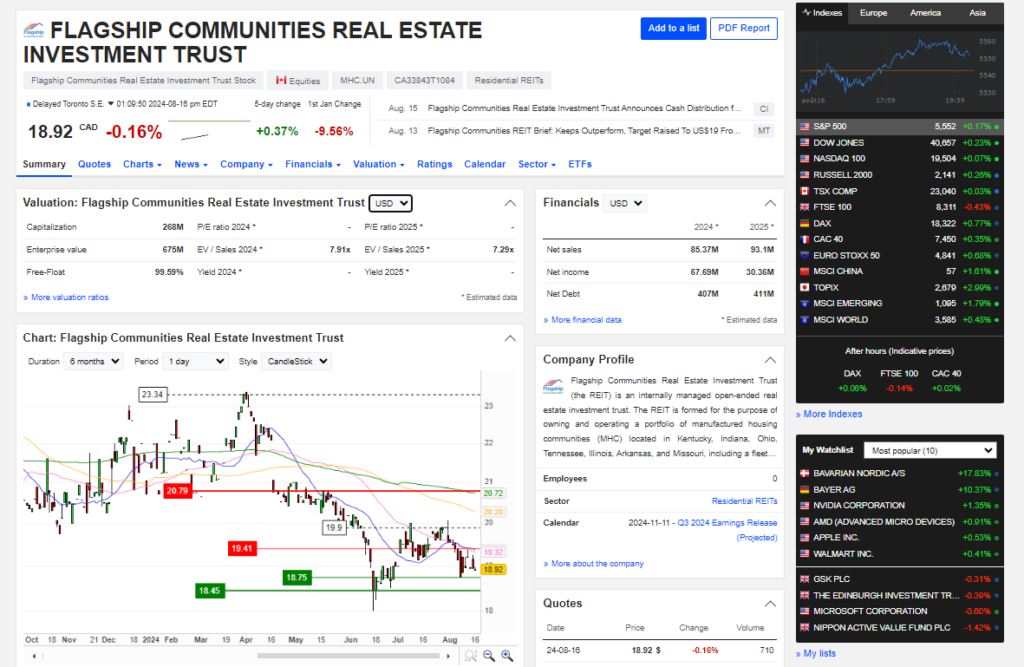

Mobile Home Park REIT Investing Quarterly Performance: Flagship Communities (FLGMF)

Stock Price Performance

Flagship Communities experienced a significant decline in its stock price during Q2 2024, closing at $14.00, down from $17.25 in Q1 2024. When compared to the same period last year, where the stock price was $16.25 at the end of June, this marks a downward trend over the past 12 months. This drop in stock price may reflect broader market pressures or investor concerns, though the company’s operational performance suggests a more nuanced story.

Net Operating Income (NOI)

Despite the downward trend in stock price, Flagship Communities reported strong growth in Net Operating Income (NOI) for Q2 2024. The NOI for this quarter reached $14.06 million, up from $13.3 million in Q1 2024 and significantly higher than the $11.58 million reported in the same quarter last year. This upward trend in NOI highlights the company’s ability to increase revenue through rent hikes and strategic infill, which is the process of adding new homes to existing communities to maximize occupancy and income.

Occupancy Rates

Flagship Communities REIT achieved an increase in occupancy during Q2 2024, with the rate rising to 87.4%, up from 83.9% in the previous quarter. This improvement in occupancy is notable, especially considering the ongoing expansion efforts, such as the addition of 81 new lots in Louisville, Kentucky. These expansions initially impact overall occupancy rates, but as new homes are filled, they contribute positively to the company’s long-term financial stability. The year-over-year comparison shows a clear upward trend in occupancy, driven by effective infill strategies.

Lot Rent Growth

Lot rent growth remains a critical factor in Flagship Communities’ revenue generation. In Q2 2024, the average lot rent held steady at $447, consistent with the previous quarter. However, this represents a 6.5% increase compared to the same period last year. The rise in lot rents can be attributed to inflationary pressures and the continued high demand for affordable housing. Flagship Communities has effectively leveraged these factors to maintain competitive lot rents while ensuring high occupancy.

Portfolio and Acquisitions

Flagship Communities has made strategic moves to expand its portfolio, reflecting a significant growth trajectory over the past year. As of Q2 2024, the company owned 15,105 lots, up from 12,743 in the previous quarter. This substantial increase is partly due to the acquisition of new communities and the completion of expansions within existing properties, such as the 81-lot expansion in Louisville, Kentucky. The company’s focus on expanding its footprint in key markets demonstrates a commitment to long-term growth and increased revenue generation.

In Q1 2024, Flagship Communities reported a 67% NOI margin, highlighting the efficiency of its operations. The company also expanded its portfolio by acquiring new properties and adding lots, contributing to its overall growth strategy. This expansion is a clear indication of Flagship’s ability to identify and capitalize on market opportunities, further solidifying its position in the mobile home park REIT sector.

Summary

Flagship Communities REIT has shown resilience and growth in Q2 2024, despite a noticeable decline in stock price. The company’s strong NOI growth, improved occupancy rates, and strategic portfolio expansion highlight its potential for continued success in the mobile home park sector. While the stock price may reflect short-term market concerns, the underlying financial and operational performance of Flagship Communities suggests a solid foundation for future growth.

Investors should monitor how Flagship Communities continues to manage its expansion and whether the recent additions to its portfolio will translate into sustained occupancy and income growth. The company’s focus on strategic acquisitions and rent growth positions it well for long-term success in the REIT space.

View the Quarterly Report Here!

Conclusion

The second quarter of 2024 has proven to be a pivotal period for the major mobile home park REITs. While each company faced its unique challenges and opportunities, certain commonalities emerged, such as steady NOI growth driven by effective rent increases and strategic portfolio expansions. Sun Communities and Equity LifeStyle Properties showed resilience in maintaining high occupancy rates despite slight fluctuations in stock prices. UMH Properties demonstrated strong financial health with continued growth in NOI and lot rents, though it saw a temporary dip in occupancy due to expansion efforts. Meanwhile, Flagship Communities REIT, despite a decline in stock price, achieved notable gains in occupancy and NOI, underpinned by strategic acquisitions.

Q3 2024 will be crucial to monitor how these REITs continue to manage their portfolios, adapt to market conditions, and capitalize on growth opportunities. Investors should keep a close eye on the ability of these REITs to sustain their growth trajectories and enhance shareholder value in the ever-evolving mobile home park asset class.

Are you looking for more mobile home park investing insights? Contact us below to get in touch with the Keel Team!

Learn more about mobile home park investing.

Interested in learning more about mobile home park investing? Get in touch with us today to find out more.

Disclaimer:

The information provided is for informational purposes only and is not investment advice or a guarantee of any kind. We do not guarantee profitability. Make investment decisions based on your own research and consult registered financial and legal professionals. We are not registered financial or legal professionals and do not provide personalized investment recommendations.

Tristan Hunter - Investor Relations

View The Previous or Next Post

Subscribe Below 👇