Mobile Home Park REIT Investing: Q4 2023 Quarterly Report Summary

-

Tristan Hunter - Investor Relations

Tristan Hunter - Investor Relations

Introduction to Mobile Home Park REIT Investing

Mobile Home Park REIT investing continues to offer unique value and stability for investors. As we have now closed on 2023 and well into 2024, it’s important to assess how leading Mobile Home Park REITs such as Sun Communities Inc. (SUI), Equity Lifestyle Properties (ELS), UMH Properties (UMH), and Flagship Communities (FLGMF) performed in the last quarter of 2023. This report dives into their Q4 performance in comparison to Q3, juxtaposing it with the same reporting period in the previous year. We will look at comprehensive insights into stock trends, net operating income (NOI), occupancy rates, lot rent growth and strategic growth maneuvers.

Let’s jump right in!

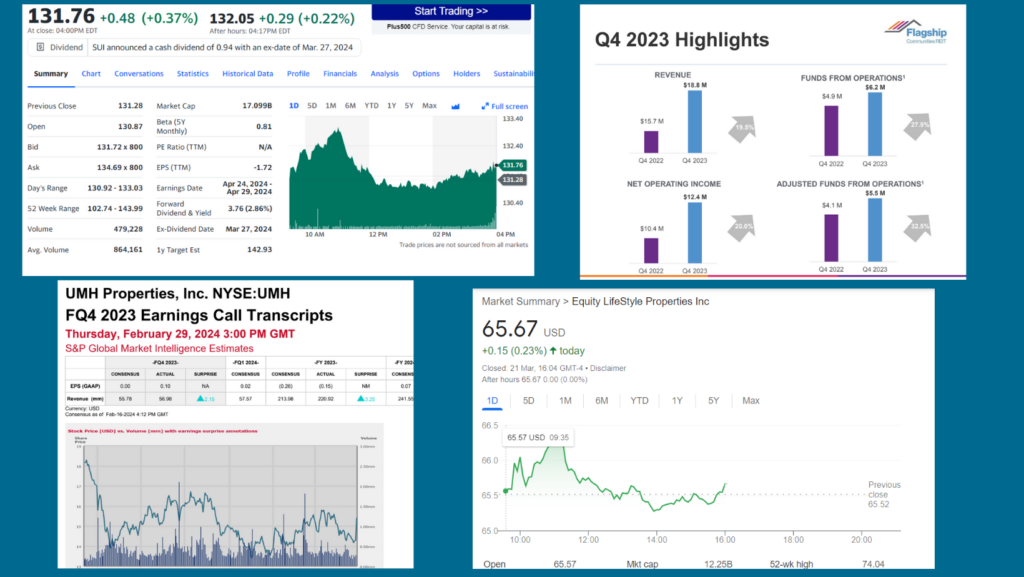

Sun Communities: Showcasing Robust Growth

Sun Communities has continued its upward trajectory, overcoming minor stock price fluctuations with significant operational achievements. The REIT’s stock price saw an uptick to $133.65 from $117.52 in the previous quarter, despite a year-over-year dip from $140.72. The NOI for Q4 reached $609,900,000, marking an 8% year-over-year increase, thanks to augmented income and asset value against rising expenses. Occupancy rates improved marginally to 97.3%, reflecting steady demand. The lot rent experienced a 6.4% year-over-year increase, underscoring Sun Communities’ ability to enhance property value effectively. With two acquisitions and a disposition in Michigan and Maine, Sun Communities demonstrates a keen eye for strategic portfolio diversification.

Equity Lifestyle Properties: Sustained Upward Momentum

ELS exhibited continuous growth, with stock prices moving upwards from $63.31 to $70.54 by year-end. They experienced a notable 5% growth in NOI for the year 2023, showcasing their solid performance and strategic operational efficiency. Despite a slight occupancy rate dip to 94.6%, ELS has maintained robust performance indicators. The lot rent experienced a 6.8% year-over-year increase, reaching $824, illustrating effective management and asset value enhancement strategies. ELS’s focus remains on expanding its high-demand Florida portfolio, with 175 new lot acquisitions since quarter 3 of 2023.

UMH Properties: Expanding and Optimizing

UMH Properties has shown commendable growth with its stock price rising to $15.10 from $13.62 in the previous quarter. The year ended with a substantial 12.5% increase in NOI, reflecting UMH’s strategic operational enhancements. Occupancy rates improved to 88.5%, a testament to the REIT’s effective tenant retention and acquisition strategies. Lot rent saw a 4.4% year-over-year increase to $524, indicating a continued emphasis on property value growth. A highlight of the quarter was the acquisition of Mighty Oak in Albany, Georgia, adding 118 newly developed homesites to its expanding portfolio.

Download our free eBook on the “10 Things to Review When Considering a Passive Mobile Home Park Investment”

By Andrew Keel

Flagship Communities: Diversifying and Strengthening

Flagship Communities experienced a slight stock price increase to $15.85, concluding the year on a positive note despite a slight overall downtrend. NOI for Q4 marked a significant upwards movement to $10,691,000 from the previous year’s $9,247,000, despite experiencing a slight decrease from Q3 2023 results. Occupancy rates slightly improved to 83.6%, indicating stable tenant demand. The lot rent saw a 6.5% year-over-year increase to $414, reinforcing Flagship’s growth and value enhancement strategy. The acquisition of three new mobile home park communities and a strategic purchase in Indiana emphasize Flagship’s commitment to diversification and market presence expansion.

Conclusion: A Year of Strategic Growth for Mobile Home Park REIT Investing

The Q4 2023 performance of mobile home park REITs underlines a year of strategic acquisitions, occupancy rate improvements, and NOI growth. Sun Communities Inc. leads with its significant NOI increase and operational efficiency, while ELS and UMH Properties demonstrate their prowess in managing and expanding their portfolios effectively. Flagship Communities’ focus on diversification and strategic acquisitions highlights its growth-oriented approach. As we step into 2024, these REITs’ strategic maneuvers set the stage for continued success in navigating the complexities of the mobile home park investment landscape, promising sustained growth and stability in the sector.

Contact us below if you are interested in learning more about alternative, passive investment strategies in mobile home park investments. Keel Team specializes in syndicating mobile home park investments, adding a ton of value and refinancing them with Agency debt (Fannie Mae/Freddie Mac). We aim to always secure at least a 15% annual cash-on-cash returns for our investors, having never performed lower than 18%! Reach out to us below for more information:

Learn more about mobile home park investing.

Interested in learning more about mobile home park investing? Get in touch with us today to find out more.

Disclaimer:

The information provided is for informational purposes only and should not be considered investment advice, nor a guarantee of any kind. There are no guarantees of profitability, and all investment decisions should be made based on individual research and consultation with registered financial and legal professionals. We are not registered financial or legal professionals and do not provide personalized investment recommendations.

Tristan Hunter - Investor Relations

View The Previous or Next Post

Subscribe Below 👇