5-Year Lot Rent Trends for the Major Mobile Home Park REITs

-

Tristan Hunter - Investor Relations

Tristan Hunter - Investor Relations

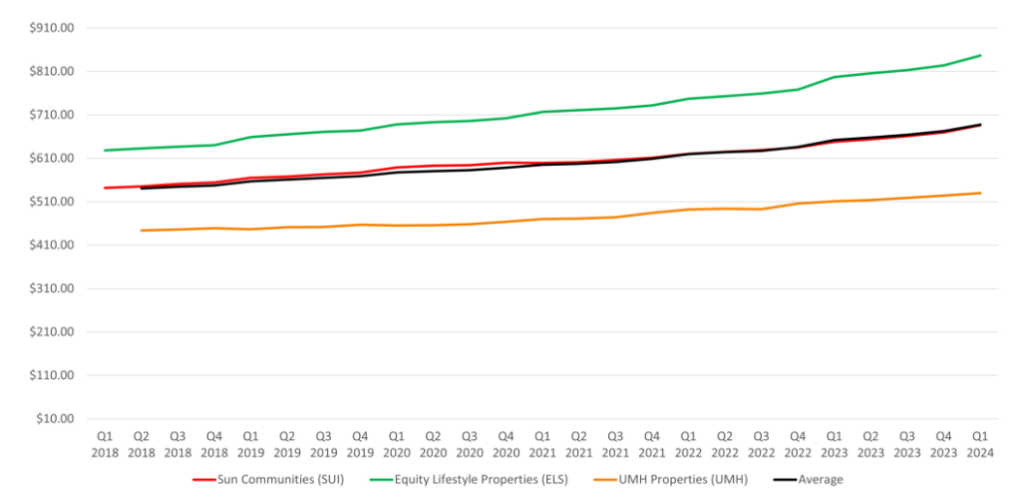

Over the past five years, the mobile home park asset class has experienced steady growth, particularly in lot rent increases. As the market matured, the major Real Estate Investment Trusts (REITs) in this sector have consistently raised lot rents each year. Despite these increases, occupancy rates have remained strong, reflecting the sector’s resilience and the ongoing demand for affordable housing. This article explores the trends in lot rent increases among the main mobile home park REITs and the factors contributing to high occupancy rates.

Steady Lot Rent Increases: A Key Trend

For the major mobile home park REITs, lot rents have increased by an average of 5-6% each year over the last five years. This trend has been consistent across various markets and reflects a strategy to align rents with rising costs for maintenance, amenities, and market demand.

While a 5-6% annual increase might seem modest, these increases are often necessary to cover rising expenses related to maintaining and improving mobile home park facilities. REITs focus on offering enhanced amenities, maintaining high standards, and ensuring that the properties remain desirable places to live. As a result, these lot rent increases reflect the value provided to residents.

The Impact on Occupancy Rates

One might assume that consistent rent increases would lead to lower occupancy rates. However, this has not been the case for the major mobile home park REITs. Occupancy rates have remained high, even as rents steadily climbed. Several factors contribute to this resilience.

Firstly, mobile home parks continue to be one of the most affordable housing options available. Even with annual rent increases, the overall cost of living in a mobile home park remains lower than many other housing alternatives. For many residents, relocating to another mobile home park or a different type of housing can be cost-prohibitive, making it more practical to stay despite the rent increases.

Secondly, the demand for affordable housing has remained consistently high, especially in markets where housing prices have surged. Mobile home parks offer a solution to this issue, providing a more affordable option for individuals and families who might otherwise be priced out of the housing market. This strong demand has helped to keep occupancy rates high, as residents seek the stability and affordability that mobile home parks offer.

REITs’ Strategy: Balancing Increases and Value

The strategy employed by mobile home park REITs often involves a careful balancing act. They aim to increase lot rents to cover rising operational costs and ensure a return on investment for shareholders. At the same time, they must maintain high occupancy rates to ensure steady cash flow and long-term stability.

One approach to achieving this balance has been through incremental rent increases that are manageable for residents. By keeping the annual increases within the 5-6% range, REITs can gradually adjust rents without causing significant financial strain on residents. This gradual approach helps mitigate the risk of residents leaving the mobile home park due to rent hikes.

Additionally, REITs have invested in improving the quality of their mobile home parks, offering better amenities, enhanced security, and well-maintained common areas. These improvements not only justify the rent increases but also enhance the overall living experience for residents. As a result, residents are more likely to accept the rent increases, knowing they receive value in return.

Are you looking for more information on passive mobile home park investing? Download our FREE eBook and learn expert insights from Andrew Keel!

Market Conditions and Their Role

Broader market conditions over the past five years have also played a role in REITs’ ability to increase lot rents while maintaining high occupancy rates. The affordable housing crisis in many parts of the country has made mobile home parks an increasingly attractive option for a wide range of people.

As traditional housing options have become less affordable, mobile home parks have emerged as a viable alternative for those seeking lower-cost living arrangements. This shift in the housing market has contributed to the sustained demand for mobile home park spaces, allowing REITs to implement annual rent increases without significantly impacting occupancy rates.

Looking Ahead: What the Future May Hold

Looking forward, the trend of lot rent increases among mobile home park REITs is likely to continue, albeit cautiously. While the 5-6% annual increases have been the norm, broader economic factors, such as inflation rates, changes in the housing market, and shifts in consumer demand, may influence future adjustments.

REITs will likely continue to focus on maintaining a balance between rent increases and occupancy rates. As long as mobile home parks remain an affordable housing option relative to other types of housing, and as long as REITs continue to provide value to their residents through well-maintained and desirable communities, occupancy rates are likely to remain high.

However, it is important to recognize that these trends are not guaranteed. Market conditions can change, and with them, the dynamics of lot rent increases and occupancy rates. REITs will need to stay agile and responsive to shifts in the market to maintain their position in the mobile home park sector.

Conclusion: A Resilient Market with Ongoing Growth

The last five years have demonstrated the resilience of the mobile home park market, particularly for the major REITs in the sector. Despite consistent year-over-year increases in lot rent, occupancy rates have remained strong, reflecting the ongoing demand for affordable housing options.

The ability of mobile home park REITs to balance rent increases with value creation for residents has been a key factor in this success. As the market continues to evolve, this approach will likely remain central to their strategy. While the future is always uncertain, the trends of the past five years suggest that mobile home parks will continue to be a vital part of the affordable housing landscape.

Learn more about mobile home park investing.

Interested in learning more about mobile home park investing? Get in touch with us today to find out more.

Disclaimer:

The information provided is for informational purposes only and is not investment advice or a guarantee of any kind. We do not guarantee profitability. Make investment decisions based on your own research and consult registered financial and legal professionals. We are not registered financial or legal professionals and do not provide personalized investment recommendations.

Tristan Hunter - Investor Relations

View The Previous or Next Post

Subscribe Below 👇