Mobile Home

Park

Investing

Mobile home parks are a passion of ours. We love this niche for many reasons, all of which we would love to discuss with you. Set up a free consultation today to discover how we can work together to acquire these commercial real estate money makers.

Communities Managed

Under Management

Full Cycle Mobile Home Park Deals

Learn more about investing in mobile home parks

$ 0

Paid to Our Investors Since 2020

Why Mobile Home Park Investing Makes Sense

01

Cash Flow

Mobile home park investments can potentially provide passive investors with reliable and consistent cash flow due to the potential for recurring rental income from the tenants that live there. Well managed mobile home parks can potentially offer stable returns over time, but there are no guarantees this will be the case. Keel Team, a recognized leader in mobile home park investing, understands many of the nuances that come with mobile home park due diligence and property management based on their extensive time and experience in the mobile home park investing space.

02

Diversification

Investing in mobile home parks can allow passive investors the ability to diversify their real estate investment portfolio into affordable housing. Mobile home parks are an alternative asset class that historically has offered low correlation with traditional stocks and bond investments (Wall Street Casino). Mobile home parks can potentially provide a hedge against market volatility due to this non-correlation. Warren Buffet would call this type of investment, one with a competitive advantage, one with a MOAT. Keel Team’s expertise in this niche can help investors benefit from diversification, with the aim of mitigating risk. However, there is no guarantee of investment success.

03

Strong Demand

There is a growing demand for affordable housing options, and mobile home parks cater to this need in the United States. With a large portion of the population seeking affordable housing, mobile home park investments can potentially offer passive investors a stable tenant base with reduced vacancy risk. Keel Team’s extensive market research and analysis has previously enabled them to identify high-demand locations for profitable investments based on their track record. However, there is no guarantee of future investment success.

04

Favorable Financing Options

Mobile home park investments are attractive to passive investors due to the availability of favorable financing options. Lenders recognize the stability of cash flows generated by mobile home parks, making it easier for investors to secure loans with favorable terms. Keel Team's strong network of financial partners and experience in structuring financing deals have helped investors have access to optimal financing solutions.

05

Tax Advantages

Investing in mobile home parks can provide several tax advantages for passive investors. Through strategies such as cost segregation, depreciation, and 1031 exchanges; investors can potentially minimize their tax liabilities and maximize after-tax returns. Keel Team’s comprehensive understanding of tax laws and regulations can help investors navigate the complexities of tax planning and potentially optimize their investment returns. There is no guarantee of tax savings, however, historically mobile home parks have been used as a tax shelter for some high net-worth families.

06

Professional Property Management

Keel Team offers internally managed property management services on their entire mobile home park portfolio. By allowing the Keel Team to handle day-to-day operations, investors can enjoy a truly passive mobile home park investment experience. Keel Team’s established network of property management experts can create efficient operations, tenant satisfaction and the potential for optimal returns for investors.

07

Inflation Hedge

Mobile home park investments can serve as an effective hedge against inflation, however, there is no guarantee of future investment success. Rental income from mobile home parks tends to increase with inflation, creating the potential for passive investors to maintain the purchasing power of their investment over time. Keel Team’s market expertise can help investors identify potential markets with strong rental growth, which can enhance the inflation-hedging benefits.

08

Value-Add Opportunities

Mobile home parks can offer numerous value-add opportunities. In today’s tough commercial real estate market, buying stabilized assets can get you into trouble. By implementing strategic improvements such as infrastructure upgrades, amenity enhancements, submetering utility costs and lot rent optimization; investors have the potential to enhance the value of their mobile home park investment. Keel Team’s experience in identifying and executing value-add strategies creates a road map for future mobile home park projects they acquire.

09

Passive Ownership

10

Capital Preservation Matters

By safeguarding capital, investors have the potential to ensure the long-term stability and profitability of their investment. It protects against potential market downturns, unforeseen expenses, and the need for property maintenance and upgrades. Capital preservation fosters financial security, mitigates risks, and enhances the overall success of mobile home park investments.

As Seen On:

Our experienced team is dedicated to providing investors with expert guidance and assistance. We strive to meet our investors’ investment needs and to help answer their questions in the best way that we can. If you would like more information, please reach out to the Keel Team today. We’re here to help!

Real Results. Real Revenue.

Mobile Home Park Investing Without the 3 T’s: Tenants, Toilets, & Trash

Hudson MHC

Berne MHC

Mahoning Manor MHP

Deer Run MHP

Hayfield Estates MHP

Wayside MHC

Alma MHP

Ludington MHP

Breckenridge MHC

Hillsdale Mobile Village

Willow Haven MHP

Due Diligence Checklist Items

Our due diligence checklist has expanded from 50 to over 350 items, reflecting the valuable insights gained from previous deals.

Protecting Investors

Our meticulous approach to due diligence aims to protect both ourselves and our investors by identifying potential risks and pitfalls upfront. There is no guarantee of a successful investment, however we try to identify items that could cause headaches for our property management team and poor returns for investors.

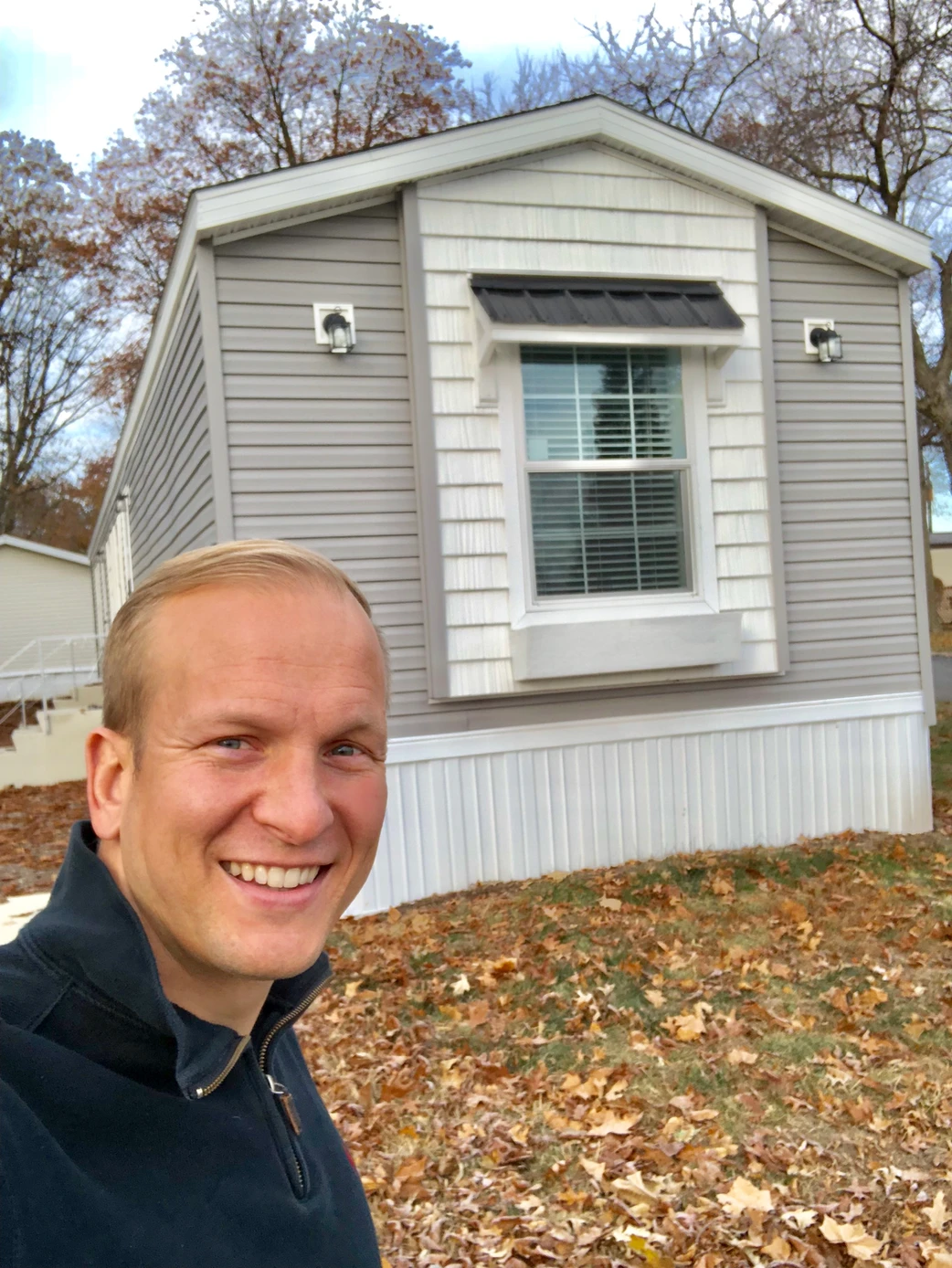

Hands-On

Operations

From the initial acquisition process to the ongoing management and improvement of the property, Andrew Keel and his team are present every step of the way. They believe that being on-site allows them to truly understand the unique characteristics and potential of each mobile home park they invest in.

When considering a new investment, Andrew Keel and his team conduct thorough due diligence, visiting the park personally to assess its condition, location, and potential for growth. By being physically present, they gain invaluable insights into the community dynamics, infrastructure, and overall market conditions that can greatly influence the success of an investment.

Once a mobile home park is acquired, Andrew Keel and his team continue their hands-on approach. They are actively involved in managing the park’s operations, overseeing maintenance, implementing upgrades, and ensuring a high standard of living for the residents. They work closely with park managers and staff, building strong relationships and fostering a sense of community within the park.

-

New Mobile Home Installation

Meticulously reviewing a new manufactured home installation, striving to meet the highest standards of quality and craftsmanship. -

New Mobile Homes Getting Skirted in Illinois

The Keel team expertly installs new skirting for mobile homes in Illinois, enhancing both the aesthetics and functionality of the properties. -

Installing New Mobile Homes in Illinois

Andrew Keel collaborates with his team to install new manufactured homes in Illinois, striving to provide quality affordable housing options to communities that need it most. -

Entry Sign of Lightle Mobile Home Park

Successfully completing the acquisition of Lightle Mobile Home Park, adding another valuable asset to the Keel Team portfolio. -

Installing Blocking Under New Mobile Home

Andrew Keel personally helps in the installation of blocking a foundation underneath a new manufactured home, aiming for a solid foundation and structural integrity. -

Electrical Inspection at Mobile Home Park

Andrew Keel works closely with his ground crew to diligently oversee electrical inspections, prioritizing safety and compliance in every mobile home park they manage. -

Mobile Home Demolition

Andrew Keel takes charge of overseeing the demolition of dilapidated mobile homes within his portfolio of mobile homes parks, striving to revitalize the communities and improve the overall quality of living for current and future residents. -

Installing Mobile Homes

Andrew Keel actively assists his team in the installation of new manufactured homes, leveraging his expertise to help create a seamless and efficient process that strives to meet the highest standards of quality.

Over 57+ Assets Under Management & Counting

We operate mobile home parks across the U.S.

Passive Investor Testimonials

Travis E.

I've been investing with the Keel Team for a while now, and they are my go-to real estate investing company. I grew up around the MHP, Self-Storage, Multi-Family environment and my family invested heavily in this space. I knew this was a space that I wanted to invest in long-term, but with my current business interests, direct involvement in that space became too much to manage on my own. Investing with the Keel Team is easy and the results have been unmatched. I receive all of the information I need to quickly and efficiently vet a deal, and once the decision is made to move forward, the documents are presented in a clear and concise manner to get up and going. Distributions and tax documents are provided on a consistent basis and I couldn't be happier. If I have the funds to invest, the Keel Team is the first location I look to invest, and I look forward to continuing that relationship. I highly recommend you do the same.

Joe H.

I would recommend that any investor consider Keel Team as part of a diversified portfolio as Andrew and team produce consistent income as well as growth. I have been with Andrew several years as he is honest explaining all risks and rewards. I was considering purchasing a mobile home park as a solo investor and realized after attending the seminar that learning and implementing all the procedures would have been too much while running a full time business. You are getting all of Andrew's experience and expertise avoiding the learning curve on your own. So Andrew is a good fit for any investor. We will continue to add investment with Andrew as this will contribute to our retirement income.

Leon H.

Recently finished my first deal with the Keel Team, they really knocked the ball out of the park! The team started the project when covid-19 was raging spread. Despite this challenging operating environment, they delivered results ahead of every milestone while communicated with limited partners with quarterly reports and transparent operational documents. The project was not only completed a year ahead of schedule, but the higher asset quality also brought many optionality's at exit refi. The deal ended with a refi rate that’s about 200 bps below expectation while keeping the asset with a low-risk profile. I am thankful for the Keel team’s professionalism and trustworthiness. I am partnering with them with more deals in the future as I have not experienced a more hands-off investment than this.

Joel M.

Andrew and his team have executed the business plan on the mobile home park we invested in beautifully! Not only are they doing what they outlined in the plan, they are doing it ahead of the schedule! Needless to say I am very pleased, especially as a passive investor. It's very gratifying to get results like this and be kept in the loop along the way. The communication has been timely and accurate and I continue to be impressed with the professionalism of the Keel Team.

Isaac B.

There aren't many operators who say what they do and do what they say, but Andrew and the excellent Keel Team are the exception. They operate with absolute transparency and honesty, hit proforma projections, and generally exceed expectations. In this investing climate, finding a group like the Keel Team is a lighthouse in the stormy harbor.

Have any questions? Reach out to our team.

Ask about mobile home park investing and how it can change your life. The mobile home park asset class is one of the most affordable forms of non-subsidized housing in the U.S., with the potential to bring investors some of the highest returns in any real estate vertical.

General Testimonials

Alan Bush

It has been a pleasure working with the Keel Team/4brothers group/s! We are now on our 4th facility loan and it has been an interesting opportunity. When they initially contacted us, it was a totally cold call. Reliance State Bank considers ourselves a Community Bank, with virtually all of our customers located within our marketing area. The initial financing request was for facilities within our trade area, but ownership entities were not.

All members of this group have been fantastic to work with. From the start, their financing requests include very detailed info about the existing ownership entities, cash flow studies (past and present), community details, complete financials and future plans to implement efficiencies going forward. They provide historical information about their existing ownership locations.

They are very responsive and willing to provide timely info needed. One of their key people in the process is Mariska Jackson, who works from South Africa. She is an amazing young lady to work with, as professional and nice a person as you will find anywhere. On our recent project, we have been working more with Wes Coetzee, equally impressive.

Darryl Jorgenson

I am a business lender with a regional bank and have originated loans for the Keel Team and their affiliates on multiple occasions. The Keel Team members are professional and very knowledgeable about the real estate industry. Inevitably many challenges will arise throughout the loan process, the Keel Team helped to resolve every challenge efficiently and quickly. It was a pleasure working with the entire team and I hope to work with the Keel Team many more times in the future.

Tom Wallace

Our experience working with Andrew Keel, his team, and the 4 Brothers team was excellent. Working directly with Andrew and his team solidified the loan terms to which we would mutually agree. Thereafter, his team, and the 4 Brothers team, were very helpful and communicative to provide the information we needed for underwriting and to bring the deal to a successful closing. The working relationship was very good, and we look forward to more opportunities to work with the Keel team and 4 Brothers team in the future.

Ram Levinger

The Keel Team and I have closed between $10-$20 million in the Mobile Home Park and Self-Storage industries over the last six years. They have repeatedly demonstrated professionalism and expertise in their field by consistently providing pertinent information in a timely manner. Their understanding and communication of their own transaction history, as it relates to historical metrics and market data, makes it easy to determine loan eligibility and lender interest. They have always paid their loans on time and have been extremely responsive borrowers. I look forward to working with them more in the future.

![]()